Sent via email, as requested, to OCF@cms.hhs.gov

Re: Oncology Care First Model: Informal Request for Information

Dear Administrator Verma and Acting Director Bassano:

On behalf of the Board of Directors of the Community Oncology Alliance (“COA”), we are submitting this comment letter regarding the Oncology Care First Model: Informal Request for Information.

As you know, COA is an organization that is dedicated to advocating for the complex care and access needs of patients with cancer and the community oncology practices that serve them. COA is the only non-profit organization in the United States dedicated solely to independent community oncology practices, which serve the majority of Americans receiving treatment for cancer. COA’s mission is to ensure that patients with cancer receive quality, affordable, and accessible cancer care in their own communities where they live and work. For 17 years, COA has built a national grassroots network of community oncology practices to advocate for public policies to support patients with cancer.

We appreciate CMS’s decision to issue an informal request for information (“RFI”) on the Oncology Care First (“OCF”) model, a new oncology payment model for participants in the current Oncology Care Model (“OCM”), as well as all other cancer care providers. We support CMS’s effort to transition providers into value-based care arrangements that will improve quality of care, lower costs, and enhance patient experience. Value-based care solutions via alternative payment models (“APMs”) create opportunities for different providers to participate and succeed in unique and dynamic arrangements.

As you know, COA has been extremely active in supporting OCM participants. Today, COA has over 80 percent of the OCM participants networked in an interactive community that includes regular calls and meetings, a dedicated listserv, access to subject matter experts, and more. The purpose is to support participants’ involvement and success in the OCM.

In advance of the release of the OCF Model RFI, in May 2019, COA submitted its OCM 2.0 Proposal to the Physician Technical Advisory Committee (“PTAC”),as well as sent a letter to the CMS Innovation Center (“CMMI”) detailing necessary changes that we believed needed to be made to the OCM to address and fix problems with the model, especially before moving forward to a next-generation model. Since that time, COA’s Oncology Payment Reform Committee has continued to engage with CMS/CMMI on matters of oncology payment reform to further evolve cancer care.

Through our continued engagement, COA looks forward to working directly with the CMMI OCF Model team to shape this model’s design and methodology so that it is a viable model that will attract the participation of both OCM participants and non-participants.

We note that the OCF Model as conceptually proposed will significantly alter the physician reimbursement landscape for community cancer care programs. As you know, over the past 15 years there has been dramatic consolidation in the nation’s cancer care delivery landscape, with many treatment sites closing and independent community oncology practices merging into large, more expensive hospital health systems, most with lucrative 340B drug discounts. It has been documented that consolidation has created cancer care access issues, especially in rural areas, and has increased Medicare costs. As a result, it is critical that the OCF Model, which is a voluntary, two-sided risk model, be designed as a realistic, financially-viable model for independent community oncology practices.

We appreciate CMS’s commitment to increasing the number of advanced payment models (“APMs”) for providers to join and increasing the number of specialty-focused APMs. We firmly believe that OCM has improved the care of patients with cancer in the United States. While we are pleased that CMS is moving in the direction of value-based care, we have significant concerns regarding some of the OCF Model RFI parameters. Specifically, our areas of concern and potential methodology changes requiring additional information are as follows:

- OCF Model Timeline & Opportunity for Stakeholder Feedback

- Practice Transformation Activities & Gradual Implementation of Electronic Patient-Reported Outcomes (“ePROs”)

- Proposed Payment Methodology Changes

- Evolution of Enhanced Payment Structure: Creation of the Monthly Population Payment (“MPP”)

- MPP & Performance-Based Payment (“PBP”) Calculations

- “Shared Savings” vs. “Gainsharing”

- Proposed Enhancements to the Prediction Model

- Proposed Novel Therapy Adjustment (“NTA”) & Trend Factor (“TF”) Methodology Changes

- Risk Issues: Transition, Transparency, and Data

- Transition to Two-Sided Risk

- Risk Transparency

- Timely Data

- Potential Inclusion of Hospital Outpatient Departments (“HOPDs”)

What follows are our specific comments and concerns about the proposed OCF model. In providing these comments, COA has relied on its Oncology Payment Reform Committee of oncologists and practice administrators with hands-on experience with the OCM and patient care.

OCF Model Timeline & Opportunity for Stakeholder Feedback

COA strongly supports the creation and testing of APMs beyond OCM through CMMI, but we remain very concerned about the proposed timeline to begin OCF Model implementation on January 1, 2021. We believe the proposed timeline is not feasible for both participating OCM practices and practices attempting to apply for OCF Model participation without prior participation in the OCM. Some practices have only just accepted a shift to down-side risk in the OCM, and most have not yet received substantial data to help them understand their performance in two-sided risk. Forcing practices with OCM experience to immediately join two-sided risk in the OCF Model would expose practices to significant volatility due to a range of uncertainties in the proposed payment methodology. We appreciate CMMI’s intent to seamlessly follow the OCF on the heels of the OCM so that there is no time gap between the models. We note that having no gap is extremely important to OCM participants. However, the OCF proposed timeline is simply unrealistic.

Recommendations:

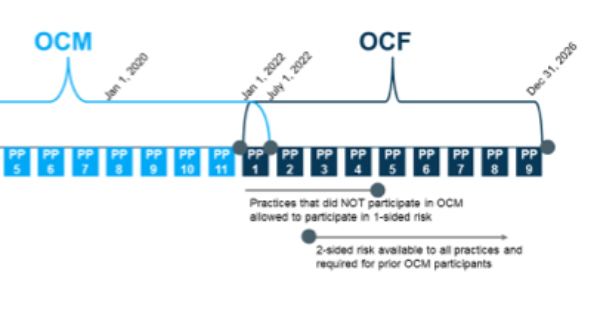

COA recommends that CMMI delay the proposed start date of the OCF by one year to January 1, 2022, add two additional performance periods to the current OCM to ensure continuity of episodes, allow existing OCM participants to participate in one-sided risk for the first year of the OCF, and extend the period to which new participants can participate in one-sided risk by an additional year. Our proposed timeline, which would greatly enhance practices’ ability to understand and prepare to bear risk in a new model, is as follows:

This timeline is much more realistic and will bridge the OCM and OCF with no gaps in between.

This timeline is much more realistic and will bridge the OCM and OCF with no gaps in between.

We remind CMMI that the Social Security Act § 1115A provides the Secretary of HHS with broad regulatory authority to test innovative payment and delivery models through CMMI, such as the OCM and OCF. The statute outlines certain requirements for testing of models, including termination or modification, expansion, and implementation. Notably, the statute creating CMMI does not contain a maximum duration requirement, such as five years. Key authorities are outlined as follows:

- Model Termination/Modification. A model must be terminated or modified after testing has begun unless the Secretary determines that the model is expected to improve the quality of care (without increasing spending), reduce spending (without reducing quality), or improve the quality of care and reduce spending. SSA § 1115A(b)(3)(B).

- Phase II Model Expansion. A model’s duration and scope may be expanded through rulemaking, subject to certain quality and spending requirements. SSA § 1115A(c).

- Waiver Authority. HHS may waive the requirements of SSA Titles XI and XVIII as necessary for the purposes of carrying out a model test. SSA § 1115A(d)(1).

Given these authorities, we believe that CMMI is permitted to and should extend the OCM by one year. CMMI has publicly acknowledged that OCM has met thresholds for savings and quality. Such a modification would not be an expansion, per se, but rather a regulatory necessity to maintain continuity of cancer care and a successful rollout of OCF. To do so, CMS could issue an interim final regulation to make the change in advance of the OCM Performance Period Nine final episode initiation date of January 1, 2021. Finally, CMMI has the authority to waive provisions of SSA Titles XI and XVIII for the purposes of carrying out demonstrations. We believe that any restrictions on demonstration length contained in the Medicare statute can be waived.

CMMI has announced most payment models through press releases or requests for applications (“RFAs”), rather than through rulemaking. Clearly, the agency understands and utilizes its regulatory flexibility to design and implement payment models. A one-year extension of an existing and important payment model – in this case, the OCM – will ensure that the successor model (the OCF) is designed and implemented properly and with the greatest possible participation.

Practice Transformation Activities & Gradual Implementation of ePROs Outcomes

COA supports the provision within the OCF Model RFI that would require model participants to implement seven physician group practice (“PGP”) redesign activities. However, COA wants to ensure that the implementation of these PGP redesign activities can be implemented by practices for maximum care team flexibility. Without the flexibility needed in implementing these required care transformation activities, the goal of advancing quality medical care for patients would become beholden to increased administrative burden. Six of the activities required for practice redesign in the OCF Model are currently required within OCM; namely:

- 24/7 access to care and medical records

- Access to patient navigation core functions

- Document 13 components of the Institute of Medicine care plan

- Utilization of guidelines

- Utilization of Certified Electronic Health Record Technology (“CEHRT”)

- Utilize data for continuous quality improvement

COA supports the continued utilization of the six practice transformation activities in OCM and applauds CMS for continuing to prioritize the importance of care coordination for patients of model participants. However, COA requests additional clarification on implementation to ensure the utilization of these practice transformation activities increases quality of care for patients and does not increase overall administrative burden.

The transition from OCM to the OCF Model should advocate for maximum flexibility for physicians and care teams in implementation of practice redesign activities. The more restrictive these requirements are, the more they restrict innovation and patient quality of care. For example, practices currently participating in OCM have underscored that using data for quality improvement has resulted in incurring more expenditures than intended in OCM for quality measures. These OCM participants have noted that the ability to implement practice redesign activities was hindered.

The gradual implementation of ePROs would be the seventh element included as a new care coordination and practice redesign activity under the OCF Model. CMMI cites the intent to utilize ePROs for monitoring patient symptoms in clinical care and identifying high-risk patients for complications or utilizations of emergency services.

COA acknowledges that the gradual implementation of ePROs, while a positive step for care coordination, has vast implications for program feasibility and implementation regarding program cost and technological infrastructure. Many barriers exist for cancer programs of all sizes to implement ePROs due to technological constraints and barriers. This administrative burden is compounded if ePRO results are to be shared with CMMI. Due to cost considerations of ePRO implementation, the OCF Model MPP needs to be proportionately adjusted to allow for ePRO implementation at a variety of different size cancer programs.

We note that the studies used to advocate for implementation of ePROs within the OCF Model were implemented outside of the community cancer care setting, both in and outside of the United States. The priority and formatting of ePRO questions are yet to be standardized in this country. CMMI needs to spend more time before OCF Model implementation to better understand the barriers of this care transformation requirement for community practices and incorporate that flexibility into the full OCF Model methodology.

Recommendations:

COA strongly recommends that CMMI review the practice redesign activities required and ensure all care transformation processes for participating practices create a framework to increase quality rather than increase administrative burden. For example, utilization of CEHRT vendors would still be required under the OCF Model framework, but COA advocates for CMMI to first verify the ability of each CEHRT vendor for their capacity to support model operations. Many OCM stakeholders, including members of COA’s Oncology Payment Reform Committee, have noted that CMS did not seek to verify the ability of electronic health record (“EHR”) vendors to adequately support practices. Moving from the OCM to the OCF Model, CMMI could better engage with the entire stakeholder community that interacts with model beneficiaries, including the CEHRT vendors, to be able to adequately support the practices in necessary data collection efforts around cost and quality measures.

Regarding potential gradual implementation of ePROs, COA recommends a ramp-up period in utilization of ePROs for all OCF Model participants. COA knows that many community oncology practices have invested substantially in ePRO technology; however, there are many practices that would not be financially or operationally prepared should ePRO utilization be required from OCF Model at the onset. In addition, with the increased resources needed for participating practices to implement ePRO technology as a practice redesign requirement, this significant allocation of resources needs to be accounted for within the OCF MPP. The OCM Monthly Enhanced Oncology Services (“MEOS”) payment is the baseline with only six practice redesign requirements; therefore, ePRO technology implementation cost and maintenance needs to be appropriately factored into the calculation of the MPP because of the additional practice redesign requirement.

COA requests that CMMI further define the gradual nature of this practice redesign requirement and better discern the timeline necessary for practice implementation once the full model methodology is released.

Proposed Payment Methodology Changes

Evolution of Enhanced Payment Structure: Creation of the MPP

COA applauds CMMI’s continued efforts to improve payment methodology in the agencies’ transition in supporting practices from the OCM through eventual transition to the OCF Model. CMMI has structured payment methodology within the OCF Model through two types of payment: the MPP as well as a PBP, similar to OCM, but with a few notable changes. COA understands the potential benefits of the proposed MPP as a monthly-prospective payment that is allocated based on both a management component (enhanced services, evaluation and management [“E&M”] visits, etc.) and an administration component (drug administration services). However, without detail on the actual methodology of calculation, COA remains highly concerned with CMMI’s implementation of the MPP. This is particularly important with all of the new CPT codes that were established for services in 2020.

The creation of the OCF Model MPP is seeking to create an appropriate valuation for ongoing practice transformation requirements within the model. While the MEOS payment within OCM has been concretely defined, the MPP, as outlined within the OCF Model RFI, is proposed to be built as a blank slate calculation, and CMMI is seeking input on what is to be included within the prospective payment structure. With a similar goal of creating a framework to encourage practice transformation in the model, the $160 MEOS payment baseline within OCM should be the baseline foundation that CMMI builds on to create the MPP payment under the OCF Model.

As has been noted in the RFI, as well as in public comments made by CMMI, CMMI’s intent is to potentially include in the MPP capitated payment for imaging, labs, drug administration, and other services that may be appropriate to be included. Also, while not formally reviewed for inclusion within the RFI, COA is aware of CMMI’s interest in potentially including the average sales price (“ASP”) 6 percent (which is in reality 4.3 percent after sequestration) add-on payment for drugs and biologics as a part of the OCF Model MPP. COA remains deeply concerned with the inclusion of these services within the MPP structure for the OCF Model, especially the potential inclusion of the drug add-on payment. Considering the diversity of services provided throughout community cancer centers in the United States, those centers that do not offer radiology, labs, or other services proposed to be included within this payment structure would be severely hindered in the provision of care under this model as a true benchmark for financial performance. Without appropriate oversight for what is included in the model’s MPP, there is a higher likelihood for participants to take advantage of certain aspects of the model’s payment methodology.

Recommendations:

COA is pleased that CMMI is giving significant thought to the structure of a prospective payment to be inclusive of all services provided under the cancer care continuum as a part of the OCF Model; however, COA remains concerned about the lack of clarity and specificity of how the MPP is defined as well as calculated. Without enough transparency into complete OCF Model payment methodology, community oncology practices will be reluctant to participate in the model. This transparency should exist in all regressions, correlations, and all other calculations that are to be used in the model. COA highly recommends that in terms of including payment for other services to be bundled as part of the MPP it start with bundling in the valuation of E&M visits with a ramp-up period defined by CMMI to slowly include other services, such as drug administration, to arrive at a more comprehensive MPP.

COA underscores that any additional payment calculation and services to be added to the OCF Model MPP requires increased transparency as well as a formal ramp-up period for community oncology practices to be able to adequately participate in the OCF model. Also, within the OCM 2.0 payment methodology, COA cites the goal of reform to simplify calculations for complete team understanding in model participation to calculate potential PBP. To align with this level of simplicity, there is an increased need for detailed payment methodology in a more formal OCF Model proposal.

COA also cautions against including the drug add-on percentage to the prospective bundle without robust evaluation and engagement with stakeholders. COA supports the drug reimbursement formula established under the Medicare Modernization Act after careful deliberations between Congress and stakeholders. We believe that the percentage-based add-ons are important to preserve in order to cover the very significant (and increasing) costs of human resources and infrastructure required to procure, handle, store, inventory, and dispose of chemotherapy and other cancer-related Part B drugs, as well as other operating expenses and bad debt. Without greater clarity as to how MPP would be calculated, we are concerned that inclusion of the drug add-on percentage in a way that does not robustly account for all these costs would expose practices to excessive risk and volatility.

We note that COA has been very engaged with Congress in proposing a “tiered” ASP add-on payment that would decrease in percentage with higher priced drugs, eventually being capped at a ceiling add-on payment rate. This was arrived at by extensive study and analysis by COA and should be considered by CMMI.

In addition to the above, and implied in the OCF Model RFI, COA also agrees with the inclusion of all clinical trial patients in the OCF. That means those trials sponsored by both pharmaceutical companies and the National Cancer Institute. Patients with cancer should have the full benefit and access to clinical trials, as their treatment dictates.

Finally, we encourage CMMI to investigate and pursue the inclusion of oral cancer drugs in the OCF Model. Oral cancer therapies are becoming more prevalent in current cancer treatment as an increasing portion of the drug development pipeline is for oral cancer drugs. Benchmarking the total cost of care must include oral therapies.

MPP & PBP Calculations

As outlined within the OCF Model RFI, CMMI would calculate the MPP to reconcile after every 6-month period-episode. COA acknowledges that OCF participants would either receive payment from CMS if the assigned population required treatment for greater than expected costs or would be required to make a recoupment payment to CMS if costs were less than expected. As proposed to be calculated, the MPP could be split among multiple PGPs and/or HOPDs participants.

The OCF Model MPP, which replaces the MEOS flat payment in OCM, would be reconciled and would take patient mix and volume into account, and would be risk adjusted. COA is concerned about the potential fluctuation in MPP based upon practice and patient risk adjustment that has yet to be defined or included in the OCF Model RFI. Without accurate representation and transparency of the range of MPP calculation, there is little incentive for community oncology practices to take on risk within this model. As payment methodology in the OCF Model RFI is currently structured, there is no way to discern how individual community oncology practices would fare under this payment structure.

While the payment methodology in the OCM model was not explicitly applied to beneficiaries receiving care at participating practices, COA underscores the need for CMMI to address beneficiary concerns around out-of-pocket costs for treatment and the responsibility to better inform beneficiaries of their practice’s program participation in the OCF Model. CMMI must understand that their communication to patients about payment and treatment was not handled effectively as part of the OCM. COA is concerned that without appropriate infrastructure to better inform beneficiaries of the model, patients will be unnecessarily burdened with model details instead of focusing on their treatment.

Recommendations:

COA recommends continued work by CMMI to develop the payment methodology in OCF, with stakeholder input, and to publicly share stakeholder feedback once concrete analysis can be conducted for community oncology practices to gauge their financial ability to participate. To ensure that the concerns of potential OCF participants are appropriately addressed, we make the following specific recommendations:

- Establish increased transparency in the OCF Model MPP calculation

- CMMI must address the lack of transparency in establishing MPP within the OCF Model. COA proposes the utilization of a formal ramp-up period that adjusts the MPP over the course of the model to gradually incorporate broader services over time. As CMMI seeks to clarify the calculation and methodology surrounding the OCF Model MPP, COA recommends that the $160 per member/per month (“PMPM”) OCM MEOS payment needs to be the starting point for how to structure the MPP in the OCF Model.

- Incorporate stratification of risk by case mix and apply it to the OCF Model MPP calculation

- Coordinate communication to OCF Model beneficiaries to ensure patient out-of-pocket costs are minimized and benefits are coordinated

- COA recommends that CMMI seek to create new G codes and determine how beneficiary cost-sharing will be set, creating the need for coordination with Medigap and patient assistance foundations as well.

- Align split attribution of MPP for model beneficiaries across PGPs and HOPDs to ensure maximum coordination across OCF Model participants

- COA recommends that the OCF Model PBP should include MPP as an expenditure as the payment will likely be an expenditure with a greater percentage of the total than the MEOS in the OCF Model.

- COA recommends that compensation should directly follow the care provided to OCF Model beneficiaries and should be appropriately evaluated for a PBP.

- COA remains supportive of MPP-only applicable episodes for beneficiaries undergoing surveillance only, but we suggest not attempting to share this payment across multiple sites of care until the agency is better equipped to display the calculation transparently and establish models that better coordinate the beneficiaries’ care. Until CMMI is prepared to provide that level of transparency, COA recommends that the OCF Model assignment and attribution of beneficiaries attach the corresponding expenditures specifically and uniquely to the OCF Model participant providing care.

“Shared Savings” vs. “Gainsharing”

Practice performance under the OCF Model would be compared against a pre-determined benchmark target per-episode based upon performance relative to all participating, and non-participating, providers. “Shared savings” in the OCM is in reality “gainsharing” in that it heavily weights a practice’s performance against itself – i.e., it’s past performance – rather than the performance of others. The OCF Model should change this to true “shared savings” whereby the practice will be compared with other providers (both practices and hospitals) within the same geography.

Currently in the OCM, a practice’s OCM discount in determining their benchmark price per episode depends on their current risk arrangement, with a 2.75 percent discount under the original 2-sided risk arrangement and 2.5 percent under the alternative two-sided risk arrangement. In the OCF Model RFI, after calculating the episode benchmark prices, CMMI proposes that the agency would create target prices for each episode in application of a discount that would be applied with the goal of producing savings to CMS. CMMI proposed that the discount would be set within a range of 3 percent to 4 percent of the determined benchmark price.

COA remains concerned that CMMI’s methodology of “gainsharing” in the OCM and the proposed OCF Model does not move beyond practices’ strict comparison against their past performance. For practices that have already achieved significant cost savings through their practice transformation and care transformation efforts, the proposed “gainsharing” methodology does little more than penalize high performers in the model from the beginning. In addition, since a practice’s benchmarks in the OCF Model have not been defined based upon the time period to be used for these calculations and performance comparators, COA requires clarification and transparency to understand the baseline period to begin to assess practice performance at the onset of the OCF Model. Increasing clarification and transparency will also greatly reduce the need for stop-loss insurance, or additional middlemen, for those that have assumed down-side risk. Reinsurance in the OCM is proving to be extremely expensive and is counter-productive to lowering the cost of cancer care. The science of covering “total covered loss” is in its infancy, and OCM participants that are opting for reinsurance are paying an added premium due to the lack of understanding and experience in covering risk in a health care delivery system by insurance brokers and insurers.

We want to note that a major problem with escalating costs in this country’s health care system is the prevalence of middlemen. Adding another middleman – a reinsurance provider – is not an effective solution in risk-based payment models that are intended to lower health care costs.

COA also encourages methodology options that address rural versus urban care. Rural patients will utilize emergency room services when a primary care provider is not available. These areas are also seeing higher stage cancers due to the lack of primary care physicians and the cancer screenings they provide. COA has reviewed studies that reflect screening, access, and compliance variances by zip code within a local area. These demographic differences can significantly impact how a practice manages patient care and is evaluated based on the total cost of care. OCM practices have revised their policies and procedures to minimize unnecessary emergency room visits; however, the outcomes of these policies and procedures in minimizing emergency room visits can be very different in rural areas where the emergency room serves as the primary care provider.

Recommendations:

COA is concerned about “shared savings” methodology under the OCF Model RFI, which is in reality “gainsharing.” In the OCF Model, practices will be competing against themselves, which is unfair to practices that have performed well in the OCM, as well as in other oncology APMs. To begin to move to a true “shared savings” methodology, it is important for CMMI to clarify the exact baseline period for the OCF Model.

COA recommends that CMMI alter the approach in the OCF Model such that it is true “shared savings” whereby practices are benchmarked against a national and/or regional comparison cohort. Key performance indicators for such a cohort can include practice size, patient risk profiles, and scope of treatments provided to better assist in a true “shared savings” comparator. COA also recommends the use of a matched non-OCF Model cohort, which could be based on the same indicators above as a potential “shared savings “comparator.

Also, across the United States, there have been high degrees of consolidation of cancer care; therefore, the geographic adjustment that is currently used within OCM, and likely to be recalibrated for the OCF Model, needs further analysis from CMMI for functional rebasing of geographic adjustments. This potential OCF Model adjustment would have the biggest impact on independent community oncology practices. In an October 2019 study on the use of novel therapies in value-based payment, and OCM specifically, research cites that there are increased examples across specific cancer types where drug expenditures account for more than half of an OCM episode spend without an emergency department visit or hospitalization. OCM currently adjusts on drug spend but considering how little variation there is in drug pricing, the methodology does not appropriately assist practices where actual variation in costs of care exist. For practices, the cost of drugs is not a variable that fluctuates, but the impact of their geographic location is a variable that fluctuates.

For the OCF Model to be applicable outside of Medicare Fee-For-Service (“FFS”), and to truly transition oncology programs comprehensively to value-based care, CMMI needs to modify its methodology so that it allows for the broader adoption and inclusion of the commercial payer landscape. Without this consideration, oncology Medicare FFS APMs from CMMI will do very little to push community cancer care into a true value-based framework. Alignment with commercial models will also assure closer alignment with other CMMI models for non-cancer care.

Proposed Enhancements to the Prediction Model

Like the OCM, the proposed OCF Model includes a prediction model, which incorporates case mix variables (i.e., covariates), including cancer type, age, comorbidities, etc. under the payment methodology. Given the clinical complexity of patients with cancer, COA appreciates the difficulty of developing a prediction model that successfully estimates an appropriate cost of care target for each patient.

Defining a Cancer-Specific Clinical Framework to Strengthen Prediction Model

Practices’ performance under the OCF will rely heavily on benchmark payments established by the prediction model. Therefore, it is critical that the prediction model methodology appropriately accounts for key drivers of cancer care. Based on the OCF Model RFI, it is unclear whether the performance period 1 (“PP1”) July 1, 2016 through January 1, 2017 of OCM, or a non-OCM period, would establish the baseline period for the OCF Model prediction model.

COA applauds CMMI for the development of a registry under OCM to collect important staging and clinical data for each treated patient. Such information – in aggregate and combined with claims data – is critical to (1) better understand the course of the disease; (2) select the most effective treatment options earlier; and (3) better define patient risk factors. However, it is unclear if and how CMMI is using this data to improve the prediction model. Should CMMI utilize PP1 as a baseline period for establishing benchmarks in the OCF Model, COA cites uncertainty in how the registry would influence baseline and benchmark prices that would be established. It is also unclear what steps CMMI is taking to select the final case mix variables that go into the prediction model and how the clinical oncology community and OCM practices are being included in the process.

If a non-OCM period is used in establishing the benchmark price for the OCF Model prediction model, COA would like to understand from CMMI how the agency plans to ensure advancements made in cancer since the advent of OCM would be recalibrated into this updated model. Due to the potential for benchmarking of the OCF Model outside of OCM, COA believes that benchmark prices should continue to take into account the therapeutic advancements in oncology that have been brought to market during OCM.

Recommendations:

COA recommends that CMMI should prioritize improvement of the prediction model’s case mix variables to better account for oncology-specific factors that more accurately predict costs. Accordingly, COA recommends that CMMI develop a clearer oncology-specific clinical framework to better predict costs. This framework should evaluate clinical factors that go beyond the broad tumor categorization such as stage of disease, subtypes of patients based on biomarkers, and use of high-cost treatment regimens.

To improve this process, COA recommends that CMMI provide greater transparency with the process for determining prediction model variables and offer opportunities (e.g., working groups) for clinicians and OCM participants to evaluate their data and make recommendations. It is important for potential OCF Model participants to understand how the complexities of their patient populations would be accounted for in the model. By providing a clear and robust methodology, potential participants can better understand the impact of the model on their performance and make the appropriate investments required to succeed in the OCF Model.

The same emphasis on transparency should also be applied to model efficiency. CMMI should consider allowing current quality initiatives (e.g., QOPI, OMH, NCQA) to count towards OCF Model quality measures and reporting requirements. This would eliminate the administrative burden for redundant reporting and work and may also encourage enrollment in the OCF Model. The COA Oncology Payment Reform Committee (each member has been a strong supporter of the OCM) was unanimous in the need to minimize the administrative burden of any reform model – including the OCF. This cannot be overemphasized.

The goal of this clinical framework should be to create more discrete sub-populations for whom expected resource expenditures and costs are more consistent and for whom quality of care can be assessed with greater validity. This framework should guide key features of payment model design, including price prediction, risk adjustment, assignment/attribution methodology, clinical data elements to collect, and quality measure selection. In addition to improving the validity of the payment model design for the OCF Model, this type of clinically oriented framework will increase the transparency of the OCF Model methodology to participants by making it clearer what is driving their results in the model and what they need to address to improve.

We strongly recommend CMMI set up a process of engagement with experts from the field, particularly those with experience in implementation of value-based models in oncology, to assist in the development of this clinical framework and related methodology.

Better Accounting for Comorbidities through the Hierarchical Condition Category Model

In the OCM, CMMI measures comorbidities through a subset of CMS Hierarchical Condition Category (“HCC”) flags. Although it is important to include HCCs in the model, COA is concerned that the utilization of HCCs does not appropriately account for patient complexity and risk. Under the current HCC flag methodology, patients with two comorbidities, regardless of the specific comorbidities, will be measured in the same way. For example, a patient with elevated cholesterol and blood pressure is comparable to a quadriplegic with HIV.

COA believes a model should account for a patient’s actual comorbidities and associated complexities when determining a case mix adjustment. Accordingly, CMS should consider an alternative approach to the utilization of HCCs for the case mix adjustment in the OCF Model.

Recommendations:

Instead of utilizing HCC flags in the OCF Model, COA recommends that CMS develop factors analogous to the risk adjustment factor (“RAF”) that augments the HCC model in other CMMI/CMS programs. This factor should be developed specifically for oncology. We believe utilizing qualitative factors that not only reflect the number of HCCs but also specific key conditions that impact outcomes and costs will significantly improve OCF compared with the OCM.

Proposed NTA and TF Methodology Changes

It is estimated that 25-40 percent of expenditures within an OCM episode can be attributed just to chemotherapy and supportive care drugs. Our observation is that some OCM participants have found that drugs account for 60 percent of the cost of care. In the OCF Model RFI, CMMI has proposed calculating an NTA and a TF at a cancer-specific level, rather than a practice-specific level in the OCF Model. COA would like to applaud CMMI for their attention to detail in this proposed methodological change to assist practices in better accounting for utilization of novel therapies.

In the May 2019 letter to CMMI on changes that COA recommended that CMMI make to the OCM, COA recommended that target price adjustments should be made at the episode level to ensure that underpricing does not occur. Also, in that letter, COA recommended an NTA adjustment be made through a cancer-specific benchmark rather than practice-specific benchmark to ensure appropriate calculation of adjustment for novel therapies used for cancer types with a smaller number of episodes.

According to a recent Avalere analysis, replacing the current OCM NTA methodology with a cancer-type specific NTA would most likely result in an increase in practices receiving a PBP. Under the OCM’s one-sided risk track, Avalere found that approximately 30 percent of participants would receive a PBP under the existing OCM methodology. While switching to a cancer-specific NTA methodology would not significantly increase the number of participants receiving a PBP, Avalere found that about 85 percent of practices that received a PBP under OCM would have received larger PBPs under the new methodology. Under the NTA methodology considered in the OCF Model, practices would only need to exceed the non-OCM participant average of NTA use for a single cancer type rather than across their entire practice in comparison to a control group to be eligible for an adjustment.

The disproportionate percentage of episode spend allocated to drug utilization is only expected to increase. COA is concerned and requests clarification on the 20 percent reduction factor prior to NTA calculation in the OCF Model. In addition, we would like further clarification on the metastatic adjustment and the NTA calculation to better assess correlation in actual model payment methodology.

Recommendations:

COA continues to recommend for the direct incorporation of drug prices in the OCF Model, as we have built into the OCM 2.0. Sixty percent to 70 percent of the total cost of care in cancer treatment is pharmaceuticals. This is the most important issue in how to evaluate cost and performance as well as appropriate versus inappropriate use of drug therapy.

While COA remains supportive of the outlined changes to a cancer-specific NTA and TF in the OCF Model, COA requests a better and more comprehensive explanation from CMMI on NTA and TF calculations.

Risk Issues: Transition, Transparency, and Data

COA appreciates CMMI’s leadership in the transition to value-based care through the implementation of different payment models. For these models to be successful, COA recognizes the importance of two-sided risk, in which practices assume financial risk for a defined patient population. However, in order for risk-bearing models to be successful and attract participants, there needs to be a smooth transition to two-sided risk, transparency and clarity regarding risk calculations, and timely data in order to help participants understand how they are performing in order to analyze the impact of risk on practice financial viability.

Transition to Two-Sided Risk

Under the OCM, practices received four periods of performance data before transitioning to two-sided risk. Before any practice assumes two-sided risk in the OCF Model, COA strongly believes that it is important to give practices, regardless of their lack of experience in the OCM, a minimum of two (2) years to understand and adjust to the new model. The OCF Model is notably different than the OCM, and practices will need time to understand (1) how to realign and/or redesign care transformation activities and (2) the impact of the payment methodology on practice finances and operations.

Two notable changes from the OCM to the OCF Model are the inclusion of surveillance patients and the grouping of HOPDs and PGPs. The inclusion of surveillance patients for the MPP will largely increase the number of patients included in the model. As a result, practices will need time to assess their infrastructure and invest in new technologies and/or protocols to track and maintain communication with patients. However, we request that surveillance patients be excluded from the “shared savings” calculations because surveillance patients require minimal involvement by the cancer care team. Sometimes this equates to semi-annual or annual visits to the oncologist. Medicare, and its beneficiaries, incur minimal expense during these “check-ups”. These lost-cost services skew averages that compare total costs of care.

The other notable change in the OCF Model is the grouping of HOPDs and PGPs when a HOPD provides chemotherapy or chemotherapy services for 25 percent or more of a PGP’s attributed episodes. In this scenario, PGP and HOPD participants would enter into agreements with CMS and participate in the OCF Model as a group. The grouping of participants will require an additional layer of communication and coordination and, while COA supports efforts to improve communication and coordination, practices will need time to understand and improve processes before transitioning to two-sided risk. Overall, the expansion of the OCF Model could lead to unpredictable outcomes on practice performance, which is why it is important to give practices a buffer period to learn about the new model prior to the assumption of financial risk.

Furthermore, for the OCF Model to garner provider buy-in and participation, COA encourages CMMI to consider a recent analysis of the Medicare Shared Savings Program (“MSSP”) program that found that accountable care organizations (“ACOs”) demonstrate “greater savings the longer they participate in the program.” Because savings are tied to experience in a model, COA believes it is not as important to require practices to immediately assume two-sided risk as it is to give practices adequate time in one-sided risk arrangements and allow them to understand the nuances of the model without pressure of incurring losses to CMMI. This is particularly important for smaller practices, regardless of OCM experience, as these practices may not be able to immediately absorb operational investments and/or recoupment.

Recommendations:

COA recommends that CMMI allow practices with OCM experience to participate in one-sided risk arrangements for at least one year before the transition to two-sided risk. However, a second year of one-sided risk should also be available for OCM participants that have taken two-sided risk. For practices with no prior OCM experience, CMMI should allow one-sided risk for at least two years before the transition to two-sided risk. Importantly, for practices that initially participated in the OCM but subsequently dropped out of the OCM, CMMI should allow one-sided risk for at least two years before the transition to two-sided risk. COA strongly believes that practices should have at least one year of one-sided risk in any model because of the significant and unique educational, operational, and financial investments associated with participation in a specific APM.

Historically, CMMI has allowed periods of one-sided risk for practices transitioning to a new payment model. For example, practices with experience in the Bundled Payments for Care Improvement (“BPCI”) Initiative were given six months of one-sided risk in BPCI Advanced, the next iteration of the BPCI program. Importantly, compared to the OCM, the OCF Model includes notable changes to the model structure and payment methodology. As such, practices should be given at least one year of one-sided risk to understand these changes and make the appropriate practice transformation investments and changes.

COA also requests that a “safe zone” exist in the OCF, just as there is in the OCM. These safe zones have had a positive impact on OCM participants to assume two-sided risk. Although a participant may not receive a performance-based payment, they also may avoid a financial penalty. COA recently administered a survey of OCM participants that revealed that all of the 20 participants that have been identified to assume two-sided risk were in the safe zone in one of the four performance periods. Ninety-five percent of these participants were in at least two performance periods.

Risk Transparency

In addition to structural differences between the OCM and OCF Model, there is general lack of clarity across key model parameters, which could affect a practice’s readiness to assume financial risk. Specifically, without more clarity on (1) calculation of the baseline period and (2) determination of risk track arrangements, practices may face significant difficulty in appropriately managing costs.

COA is concerned that the time period used to determine the baseline period will adversely impact practices with their OCM experience. Practices in the OCM have made significant investments to improve quality of care and enhance patient experience. As a result of these investments, many practices have reduced costs and achieved savings in the model. If CMMI determines that the baseline period will include a time period when practices were/are in the OCM, then practices that have reduced costs in the OCM will be at a disadvantage in the OCF Model. Specifically, practices that have performed well in the OCM will find it harder to reduce costs after already doing so in a prior model. Therefore, CMMI should consider this when determining the baseline period and be transparent with this process so that practices can make the appropriate considerations when deciding whether to participate in the OCF Model.

In the OCF Model RFI, CMMI outlined two two-sided risk tracks: “Track A” and “Track B” and stated Track A would be “less aggressive” and Track B would be “more aggressive.” COA appreciates CMMI’s inclusion of more than one risk track and different levels of risk as it creates more flexibility for practices. We appreciate CMMI’s request to have input on tiered risk. Given the complexity of evaluating this, we would encourage CMMI to have ongoing scheduled feedback sessions with engaged stakeholders to help clarify these risk arrangements. We are concerned with the lack of detail for each risk track (e.g., stop-loss/stop-gain) and the definition of “aggressive.” It is important to provide as much information as possible to practices, particularly as it relates to the risk tracks. Accordingly, COA urges CMMI to clarify these details prior to the release of the RFA so that practices can have time to make the appropriate decisions.

Recommendations:

COA recommends that CMMI provide greater transparency into the:

- Calculation and time period of the baseline period; and

- Determination of risk track arrangements

COA believes that greater transparency will help practices better decide whether to participate in the OCF Model and which risk arrangement may be most appropriate given their practice size and patient population. Furthermore, greater transparency will likely entice more practices to join the OCF Model, which will increase the overall number of providers and patients in another CMMI advanced APM.

Timely Data

COA underscores the importance of receiving performance data in a timely fashion in an effort to ensure high-quality, value-driven care. Given the level of risk in the OCF Model, it will be essential for practices to understand their performance in real time in order to improve practice management and enhance performance in future periods.

COA understands the time investment and operational burden with providing practices with frequent data. However, other providers in other bundled payment models, including BPCI and BPCI-A, receive data on a monthly basis, which allows providers to better track and manage their patients. By providing monthly data, providers in these models have been able to (1) better manage patients; (2) identify opportunities for practice-level improvement; and (3) understand potential financial impacts and plan accordingly. We believe there will be even more opportunities for patient, practice, and model level success with frequent data because of the episode length in the OCF Model. If practices receive monthly data and identify opportunities for improvement for specific patients, because the episode length is so long, practices can then course correct and have a meaningful impact on a patient’s care and improve the overall care process and experience in the model.

Recommendations:

COA recommends that at a minimum CMMI (1) provide practice performance reports no later than three months following each performance period and (2) provide monthly data feeds of patients included in the OCF Model to practices. Providing more data to practices will allow for continual quality and financial improvement. We believe that for practices to succeed in any payment model, CMMI should provide practices with as much data as possible on a regular, timely basis in effort to support practice transformation and improved patient outcomes.

Overall, COA strongly believes that prior to the transition to two-sided risk, practices must (1) have adequate time in the OCF Model to understand the model and their performance; (2) understand the methodology behind CMMI’s calculations related to the baseline period and risk tracks; and (3) receive timely data to make the appropriate care delivery changes so that patients can receive high-quality, low-cost care.

Potential Inclusion of HOPDs

As a part of potential changes to attribution methodology under the OCF Model, the OCM Model RFI distinguishes between “assigned beneficiaries” and “attributed beneficiaries” for the purpose of calculating the MPP versus the PBP in the OCF Model. As proposed, PGPs are required to group with HOPDs if the HOPD provides chemotherapy or relevant services for 25 percent of a PGP’s episodes. CMMI continues to position the OCF Model as a multi-payer model facilitated by memos of understanding between Medicaid and commercial payers with CMMI. However, COA remains concerned that the proposed attribution infrastructure could not adequately support the needs of commercial payers and employers to participate in the OCF Model as outlined.

To attribute beneficiaries, CMMI proposed the potential trigger of episodes to be based upon diagnosis rather than chemotherapy administration, which seeks to include the broader cancer care continuum within the OCF Model. COA is supportive of this attribution change but seeks clarity on how the broadening of attribution of this proposed model would affect the proposed payment methodology, as well as impact beneficiaries.

COA seeks clarification on the potential inclusion of HOPDs as participants eligible for a portion of the model’s payment methodology through the current attribution framework. COA asserts this potential proposal within the OCF Model is an important step in creating site payment parity between HOPDs and independent community-based physician practices. Higher Medicare and private payer reimbursement for hospital outpatient clinics has provided significant financial incentives for hospitals to acquire independent community oncology practices, which has been well documented. A February 2019 study concluded that not only were hospital prices higher than physician prices, but in the period 2007-2014 they grew at a faster rate. The study found that for hospital-based outpatient care, hospital prices grew 25 percent, while physician prices grew six percent. Most of the growth in payments for inpatient and hospital-based outpatient care was driven by growth in hospital prices, not physician prices. In addition, a 2017 study found that the mean total cost paid per month across all cancers was significantly lower for patients who were treated in an independent community-based practice ($12,548) compared with those who were treated in a hospital practice ($20,060).

Recommendations:

COA has strongly supported previous regulatory and legislative efforts to achieve payment site-neutrality. We will continue to support additional efforts, such as the continuation of the reduced payment rate policy. In oncology, COA ultimately seeks site-neutral payments for all hospitals, general and cancer-specific. This includes ending special carve-outs for dedicated large cancer hospitals that result in increased costs for beneficiaries and Medicare.

In addition, because attribution of a beneficiary is expressly tied to a practice’s MPP and PBP, COA seeks clarification on the trigger of episodes and beneficiary attribution to better understand how CMMI’s attribution of beneficiaries within an episode addresses those not actively undergoing treatment.

Conclusion

Before we conclude our comments, we want to make two very strong recommendations. First, please waive the application requirement for OCM practices who want to participate in the OCF Model. At the very least, the application should be very simple to complete. Second, please streamline the application process for those practices that intend to participate in the OCF Model but have not participated in the OCM. Our message is simple and consistent with the CMS goal of putting patients over paperwork.

Additionally, we note that even with the additional time CMS/CMMI provided to make these comments on the OCF Model RFI, there are several important areas of concern we are still discussing and analyzing in relation to the cost of cancer care under the OCF Model. Those include, but are not limited to, 1) issues regarding precision medicine and the increasing number of newer targeted cancer therapies, especially their companion diagnostic tests with no standardized process to assess clinical utility and coverage decisions (and resultant impact on the total cost of cancer care); and 2) the hurdles and restrictions insurers and pharmacy benefit managers are placing on the utilization of biosimilars to reduce the cost of cancer care.

CMMI is well positioned to strengthen the overall structure and financial risk structure of the OCF Model. More importantly, CMMI has the potential to create a robust oncology payment model that can incentivize broad provider participation and transformation in the delivery of cancer care. CMMI will achieve its goal of creating a successor model to the OCM if the agency works closely in concert with oncology providers.

COA appreciates the opportunity to comment on the information provided in the RFI for a proposed OCF Model and we look forward to discussing this model and more specifics with the CMMI OCF team further. We are extremely willing to work with the team to ensure the final OCF Model is appropriately flexible for patients and qualified providers, including community oncologists, and that it results in high-quality, low-cost care, and enhanced patient experiences for all patients included in the model.

We look forward to discussing the issues detailed in this letter with the CMMI team, who have been very open to our input. Please do not hesitate to reach out with any questions.

Sincerely,

Michael Diaz, MD

President

Ted Okon

Executive Director

COA Comments on Oncology Care First (OCF) Model Informal Request for Information

Sent via email, as requested, to OCF@cms.hhs.gov

Re: Oncology Care First Model: Informal Request for Information

Dear Administrator Verma and Acting Director Bassano:

On behalf of the Board of Directors of the Community Oncology Alliance (“COA”), we are submitting this comment letter regarding the Oncology Care First Model: Informal Request for Information.

As you know, COA is an organization that is dedicated to advocating for the complex care and access needs of patients with cancer and the community oncology practices that serve them. COA is the only non-profit organization in the United States dedicated solely to independent community oncology practices, which serve the majority of Americans receiving treatment for cancer. COA’s mission is to ensure that patients with cancer receive quality, affordable, and accessible cancer care in their own communities where they live and work. For 17 years, COA has built a national grassroots network of community oncology practices to advocate for public policies to support patients with cancer.

We appreciate CMS’s decision to issue an informal request for information (“RFI”) on the Oncology Care First (“OCF”) model, a new oncology payment model for participants in the current Oncology Care Model (“OCM”), as well as all other cancer care providers. We support CMS’s effort to transition providers into value-based care arrangements that will improve quality of care, lower costs, and enhance patient experience. Value-based care solutions via alternative payment models (“APMs”) create opportunities for different providers to participate and succeed in unique and dynamic arrangements.

As you know, COA has been extremely active in supporting OCM participants. Today, COA has over 80 percent of the OCM participants networked in an interactive community that includes regular calls and meetings, a dedicated listserv, access to subject matter experts, and more. The purpose is to support participants’ involvement and success in the OCM.

In advance of the release of the OCF Model RFI, in May 2019, COA submitted its OCM 2.0 Proposal to the Physician Technical Advisory Committee (“PTAC”),as well as sent a letter to the CMS Innovation Center (“CMMI”) detailing necessary changes that we believed needed to be made to the OCM to address and fix problems with the model, especially before moving forward to a next-generation model. Since that time, COA’s Oncology Payment Reform Committee has continued to engage with CMS/CMMI on matters of oncology payment reform to further evolve cancer care.

Through our continued engagement, COA looks forward to working directly with the CMMI OCF Model team to shape this model’s design and methodology so that it is a viable model that will attract the participation of both OCM participants and non-participants.

We note that the OCF Model as conceptually proposed will significantly alter the physician reimbursement landscape for community cancer care programs. As you know, over the past 15 years there has been dramatic consolidation in the nation’s cancer care delivery landscape, with many treatment sites closing and independent community oncology practices merging into large, more expensive hospital health systems, most with lucrative 340B drug discounts. It has been documented that consolidation has created cancer care access issues, especially in rural areas, and has increased Medicare costs. As a result, it is critical that the OCF Model, which is a voluntary, two-sided risk model, be designed as a realistic, financially-viable model for independent community oncology practices.

We appreciate CMS’s commitment to increasing the number of advanced payment models (“APMs”) for providers to join and increasing the number of specialty-focused APMs. We firmly believe that OCM has improved the care of patients with cancer in the United States. While we are pleased that CMS is moving in the direction of value-based care, we have significant concerns regarding some of the OCF Model RFI parameters. Specifically, our areas of concern and potential methodology changes requiring additional information are as follows:

What follows are our specific comments and concerns about the proposed OCF model. In providing these comments, COA has relied on its Oncology Payment Reform Committee of oncologists and practice administrators with hands-on experience with the OCM and patient care.

OCF Model Timeline & Opportunity for Stakeholder Feedback

COA strongly supports the creation and testing of APMs beyond OCM through CMMI, but we remain very concerned about the proposed timeline to begin OCF Model implementation on January 1, 2021. We believe the proposed timeline is not feasible for both participating OCM practices and practices attempting to apply for OCF Model participation without prior participation in the OCM. Some practices have only just accepted a shift to down-side risk in the OCM, and most have not yet received substantial data to help them understand their performance in two-sided risk. Forcing practices with OCM experience to immediately join two-sided risk in the OCF Model would expose practices to significant volatility due to a range of uncertainties in the proposed payment methodology. We appreciate CMMI’s intent to seamlessly follow the OCF on the heels of the OCM so that there is no time gap between the models. We note that having no gap is extremely important to OCM participants. However, the OCF proposed timeline is simply unrealistic.

Recommendations:

COA recommends that CMMI delay the proposed start date of the OCF by one year to January 1, 2022, add two additional performance periods to the current OCM to ensure continuity of episodes, allow existing OCM participants to participate in one-sided risk for the first year of the OCF, and extend the period to which new participants can participate in one-sided risk by an additional year. Our proposed timeline, which would greatly enhance practices’ ability to understand and prepare to bear risk in a new model, is as follows:

We remind CMMI that the Social Security Act § 1115A provides the Secretary of HHS with broad regulatory authority to test innovative payment and delivery models through CMMI, such as the OCM and OCF. The statute outlines certain requirements for testing of models, including termination or modification, expansion, and implementation. Notably, the statute creating CMMI does not contain a maximum duration requirement, such as five years. Key authorities are outlined as follows:

Given these authorities, we believe that CMMI is permitted to and should extend the OCM by one year. CMMI has publicly acknowledged that OCM has met thresholds for savings and quality. Such a modification would not be an expansion, per se, but rather a regulatory necessity to maintain continuity of cancer care and a successful rollout of OCF. To do so, CMS could issue an interim final regulation to make the change in advance of the OCM Performance Period Nine final episode initiation date of January 1, 2021. Finally, CMMI has the authority to waive provisions of SSA Titles XI and XVIII for the purposes of carrying out demonstrations. We believe that any restrictions on demonstration length contained in the Medicare statute can be waived.

CMMI has announced most payment models through press releases or requests for applications (“RFAs”), rather than through rulemaking. Clearly, the agency understands and utilizes its regulatory flexibility to design and implement payment models. A one-year extension of an existing and important payment model – in this case, the OCM – will ensure that the successor model (the OCF) is designed and implemented properly and with the greatest possible participation.

Practice Transformation Activities & Gradual Implementation of ePROs Outcomes

COA supports the provision within the OCF Model RFI that would require model participants to implement seven physician group practice (“PGP”) redesign activities. However, COA wants to ensure that the implementation of these PGP redesign activities can be implemented by practices for maximum care team flexibility. Without the flexibility needed in implementing these required care transformation activities, the goal of advancing quality medical care for patients would become beholden to increased administrative burden. Six of the activities required for practice redesign in the OCF Model are currently required within OCM; namely:

COA supports the continued utilization of the six practice transformation activities in OCM and applauds CMS for continuing to prioritize the importance of care coordination for patients of model participants. However, COA requests additional clarification on implementation to ensure the utilization of these practice transformation activities increases quality of care for patients and does not increase overall administrative burden.

The transition from OCM to the OCF Model should advocate for maximum flexibility for physicians and care teams in implementation of practice redesign activities. The more restrictive these requirements are, the more they restrict innovation and patient quality of care. For example, practices currently participating in OCM have underscored that using data for quality improvement has resulted in incurring more expenditures than intended in OCM for quality measures. These OCM participants have noted that the ability to implement practice redesign activities was hindered.

The gradual implementation of ePROs would be the seventh element included as a new care coordination and practice redesign activity under the OCF Model. CMMI cites the intent to utilize ePROs for monitoring patient symptoms in clinical care and identifying high-risk patients for complications or utilizations of emergency services.

COA acknowledges that the gradual implementation of ePROs, while a positive step for care coordination, has vast implications for program feasibility and implementation regarding program cost and technological infrastructure. Many barriers exist for cancer programs of all sizes to implement ePROs due to technological constraints and barriers. This administrative burden is compounded if ePRO results are to be shared with CMMI. Due to cost considerations of ePRO implementation, the OCF Model MPP needs to be proportionately adjusted to allow for ePRO implementation at a variety of different size cancer programs.

We note that the studies used to advocate for implementation of ePROs within the OCF Model were implemented outside of the community cancer care setting, both in and outside of the United States. The priority and formatting of ePRO questions are yet to be standardized in this country. CMMI needs to spend more time before OCF Model implementation to better understand the barriers of this care transformation requirement for community practices and incorporate that flexibility into the full OCF Model methodology.

Recommendations:

COA strongly recommends that CMMI review the practice redesign activities required and ensure all care transformation processes for participating practices create a framework to increase quality rather than increase administrative burden. For example, utilization of CEHRT vendors would still be required under the OCF Model framework, but COA advocates for CMMI to first verify the ability of each CEHRT vendor for their capacity to support model operations. Many OCM stakeholders, including members of COA’s Oncology Payment Reform Committee, have noted that CMS did not seek to verify the ability of electronic health record (“EHR”) vendors to adequately support practices. Moving from the OCM to the OCF Model, CMMI could better engage with the entire stakeholder community that interacts with model beneficiaries, including the CEHRT vendors, to be able to adequately support the practices in necessary data collection efforts around cost and quality measures.

Regarding potential gradual implementation of ePROs, COA recommends a ramp-up period in utilization of ePROs for all OCF Model participants. COA knows that many community oncology practices have invested substantially in ePRO technology; however, there are many practices that would not be financially or operationally prepared should ePRO utilization be required from OCF Model at the onset. In addition, with the increased resources needed for participating practices to implement ePRO technology as a practice redesign requirement, this significant allocation of resources needs to be accounted for within the OCF MPP. The OCM Monthly Enhanced Oncology Services (“MEOS”) payment is the baseline with only six practice redesign requirements; therefore, ePRO technology implementation cost and maintenance needs to be appropriately factored into the calculation of the MPP because of the additional practice redesign requirement.

COA requests that CMMI further define the gradual nature of this practice redesign requirement and better discern the timeline necessary for practice implementation once the full model methodology is released.

Proposed Payment Methodology Changes

Evolution of Enhanced Payment Structure: Creation of the MPP

COA applauds CMMI’s continued efforts to improve payment methodology in the agencies’ transition in supporting practices from the OCM through eventual transition to the OCF Model. CMMI has structured payment methodology within the OCF Model through two types of payment: the MPP as well as a PBP, similar to OCM, but with a few notable changes. COA understands the potential benefits of the proposed MPP as a monthly-prospective payment that is allocated based on both a management component (enhanced services, evaluation and management [“E&M”] visits, etc.) and an administration component (drug administration services). However, without detail on the actual methodology of calculation, COA remains highly concerned with CMMI’s implementation of the MPP. This is particularly important with all of the new CPT codes that were established for services in 2020.

The creation of the OCF Model MPP is seeking to create an appropriate valuation for ongoing practice transformation requirements within the model. While the MEOS payment within OCM has been concretely defined, the MPP, as outlined within the OCF Model RFI, is proposed to be built as a blank slate calculation, and CMMI is seeking input on what is to be included within the prospective payment structure. With a similar goal of creating a framework to encourage practice transformation in the model, the $160 MEOS payment baseline within OCM should be the baseline foundation that CMMI builds on to create the MPP payment under the OCF Model.

As has been noted in the RFI, as well as in public comments made by CMMI, CMMI’s intent is to potentially include in the MPP capitated payment for imaging, labs, drug administration, and other services that may be appropriate to be included. Also, while not formally reviewed for inclusion within the RFI, COA is aware of CMMI’s interest in potentially including the average sales price (“ASP”) 6 percent (which is in reality 4.3 percent after sequestration) add-on payment for drugs and biologics as a part of the OCF Model MPP. COA remains deeply concerned with the inclusion of these services within the MPP structure for the OCF Model, especially the potential inclusion of the drug add-on payment. Considering the diversity of services provided throughout community cancer centers in the United States, those centers that do not offer radiology, labs, or other services proposed to be included within this payment structure would be severely hindered in the provision of care under this model as a true benchmark for financial performance. Without appropriate oversight for what is included in the model’s MPP, there is a higher likelihood for participants to take advantage of certain aspects of the model’s payment methodology.

Recommendations:

COA is pleased that CMMI is giving significant thought to the structure of a prospective payment to be inclusive of all services provided under the cancer care continuum as a part of the OCF Model; however, COA remains concerned about the lack of clarity and specificity of how the MPP is defined as well as calculated. Without enough transparency into complete OCF Model payment methodology, community oncology practices will be reluctant to participate in the model. This transparency should exist in all regressions, correlations, and all other calculations that are to be used in the model. COA highly recommends that in terms of including payment for other services to be bundled as part of the MPP it start with bundling in the valuation of E&M visits with a ramp-up period defined by CMMI to slowly include other services, such as drug administration, to arrive at a more comprehensive MPP.

COA underscores that any additional payment calculation and services to be added to the OCF Model MPP requires increased transparency as well as a formal ramp-up period for community oncology practices to be able to adequately participate in the OCF model. Also, within the OCM 2.0 payment methodology, COA cites the goal of reform to simplify calculations for complete team understanding in model participation to calculate potential PBP. To align with this level of simplicity, there is an increased need for detailed payment methodology in a more formal OCF Model proposal.

COA also cautions against including the drug add-on percentage to the prospective bundle without robust evaluation and engagement with stakeholders. COA supports the drug reimbursement formula established under the Medicare Modernization Act after careful deliberations between Congress and stakeholders. We believe that the percentage-based add-ons are important to preserve in order to cover the very significant (and increasing) costs of human resources and infrastructure required to procure, handle, store, inventory, and dispose of chemotherapy and other cancer-related Part B drugs, as well as other operating expenses and bad debt. Without greater clarity as to how MPP would be calculated, we are concerned that inclusion of the drug add-on percentage in a way that does not robustly account for all these costs would expose practices to excessive risk and volatility.

We note that COA has been very engaged with Congress in proposing a “tiered” ASP add-on payment that would decrease in percentage with higher priced drugs, eventually being capped at a ceiling add-on payment rate. This was arrived at by extensive study and analysis by COA and should be considered by CMMI.

In addition to the above, and implied in the OCF Model RFI, COA also agrees with the inclusion of all clinical trial patients in the OCF. That means those trials sponsored by both pharmaceutical companies and the National Cancer Institute. Patients with cancer should have the full benefit and access to clinical trials, as their treatment dictates.

Finally, we encourage CMMI to investigate and pursue the inclusion of oral cancer drugs in the OCF Model. Oral cancer therapies are becoming more prevalent in current cancer treatment as an increasing portion of the drug development pipeline is for oral cancer drugs. Benchmarking the total cost of care must include oral therapies.

MPP & PBP Calculations

As outlined within the OCF Model RFI, CMMI would calculate the MPP to reconcile after every 6-month period-episode. COA acknowledges that OCF participants would either receive payment from CMS if the assigned population required treatment for greater than expected costs or would be required to make a recoupment payment to CMS if costs were less than expected. As proposed to be calculated, the MPP could be split among multiple PGPs and/or HOPDs participants.

The OCF Model MPP, which replaces the MEOS flat payment in OCM, would be reconciled and would take patient mix and volume into account, and would be risk adjusted. COA is concerned about the potential fluctuation in MPP based upon practice and patient risk adjustment that has yet to be defined or included in the OCF Model RFI. Without accurate representation and transparency of the range of MPP calculation, there is little incentive for community oncology practices to take on risk within this model. As payment methodology in the OCF Model RFI is currently structured, there is no way to discern how individual community oncology practices would fare under this payment structure.