2016 COA Practice Impact Report

2016 Community Oncology Alliance Practice Impact Report

Since 2010 the Community Oncology Alliance (COA) prepared a Community Oncology Practice Impact Report, tracking the changing landscape of oncology practices in the United States.

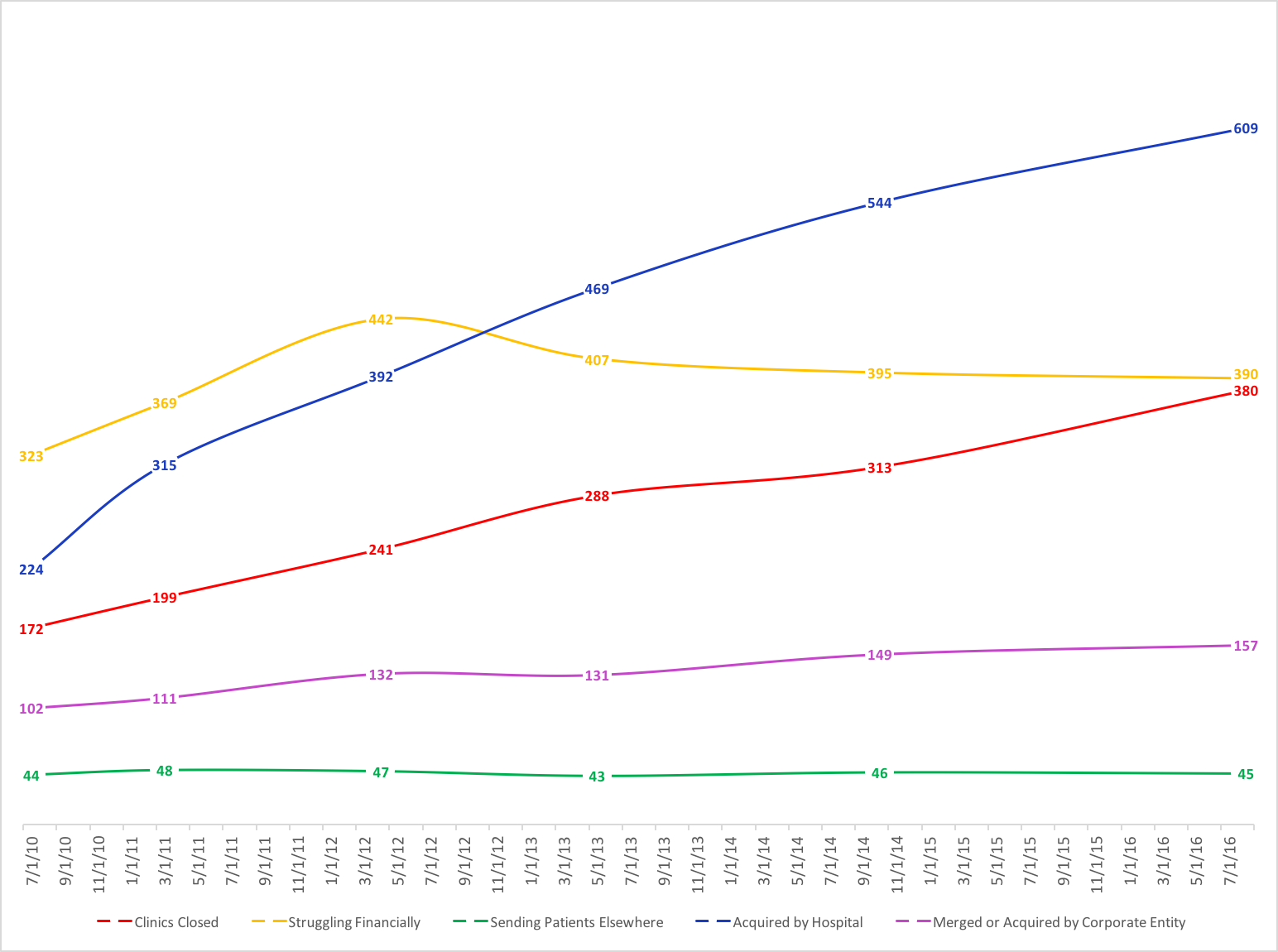

The 2016 Community Oncology Practice Impact Report documents a 121% increase in community cancer clinic closings and a 172% increase in consolidation into hospitals since 2008. In that period, 380 cancer treatment facilities have closed, and 609 community cancer practices have been acquired by or become affiliated with hospitals. Another 390 practices report that they are struggling to stay open due to financial stresses.

This is the sixth Community Oncology Practice Impact Report in the series and covers activity for a nine-year period, from January 2008 through September 2016. It notes that the monthly rate of community oncology practice closures has increased 87% since the previous practice impact report.

Compiled from public and private data sources, the 2016 Practice Impact Report provides a unique look at community oncology trends at both the national and state level. Examining local trends in states, the report shows that the largest number of community oncology practice closures have been in Florida (37), Texas (36), and Michigan (34). The states with the most practices struggling financially are Michigan (43), New York (41), and California (40). Detailed data for all states is included in the report.

Regions Map

Map with Coordinates

The Data

The 2016 Community Oncology Practice Impact Report shows that since 2008, 1,581 community clinics and/or practices nationally have been affected by closings, hospital acquisitions, and corporate mergers. This is a rate of 15.1 community practices affected per month during the observed period. Specifically, the data show:

- 380 Clinics closed — Denotes individual clinic treatment sites that have closed.

- 390 Practices struggling financially – Practices (typically comprised multiple clinic sites) that have had financial difficulties, struggling to pay bills and/or stay open.

- 45 Practices sending patients elsewhere – Practices (typically comprised multiple clinic sites) that are sending ALL of their Medicare patients elsewhere for chemotherapy.

- 609 Practices acquired by hospitals – Denotes practices (typically comprised of multiple clinic sites) that have been acquired by a hospital or, with less frequency, have entered into a contractual professional services agreement binding them to a hospital.

- 157 Practices merged or acquired – Practices (typically comprised multiple clinic sites) that have merged or been acquired by a corporate entity.

Notably, the 2016 Community Oncology Practice Impact Report shows an increasing number of practice closures since the last practice impact report. The annual rate of closures has increased 87% since the last report. Other trends COA notes since 2008:

- 121% increase in clinics closed.

- 21% increase in practices struggling financially.

- 2% increase in practices sending patients elsewhere.

- 172% increase in practices acquired by hospitals (or with a hospital agreement).

- 54% increase in practices merged or acquired.

Historical Trend in the Changing Landscape of Cancer Care

(Derived from current and past reports)

Analysis

Consolidation and hospital acquisition place an additional burden on the nearly 20% of Americans living in rural areas. If the only community cancer clinic in the area closes or is acquired by a hospital, local care may no longer be available. A morning treatment evolves into a daylong excursion. Access-limiting consolidation and closures make that scenario increasingly prevalent.

The trend of closures and consolidation of community oncology clinics into the hospital setting has had a significant and permanent impact on patient access to local, affordable cancer care. The most profound effect has been the hospital acquisition of community oncology practices, which has been fueled by the 340B drug discount program. Originally intended to support hospitals serving high numbers of indigent patients, instead, the 340B program has created a profit motive for hospitals to obtain community oncology practices.

Additionally, disparate site payment policies that reimburse hospitals more for the same cancer care they can receive in community practices has contributed to this shift. The result is that patients pay up to 53% more when they receive hospital-based cancer care versus a physician office setting. That cost is borne by both the patient and the system, most often Medicare. In 2014 alone Medicare spending would have been about $2 billion lower if the site of chemotherapy had not shifted to the hospital setting.

Studies by Avalere, BRG, Milliman, and The Moran Group have shown both the higher cost of cancer care delivered in hospital settings and the impact of the 340B drug discount program. It is noteworthy that despite the severe pressures facing community cancer clinics, they lead the way in enhancing the quality of cancer care and controlling costs through new care delivery models, such as the Oncology Medical Home and Oncology Care Model.

COA Comment

“In the nine years since this report was first issued, 1,581 community oncology practices have closed, been acquired, merged or are struggling to stay open. An average of 3.6 practices have closed per month since COA began tracking this data,” said Bruce J. Gould, MD, president and medical director of Northwest Georgia Oncology Centers in Marietta, Ga., and president of COA. “Treatment advances like oral drugs and immunotherapy, have the potential to save lives. That will not matter if patients can no longer afford care or if care simply disappears from their community.”

“In the nine years since this report was first issued, 1,581 community oncology practices have closed, been acquired, merged or are struggling to stay open. An average of 3.6 practices have closed per month since COA began tracking this data,” said Bruce J. Gould, MD, president and medical director of Northwest Georgia Oncology Centers in Marietta, Ga., and president of COA. “Treatment advances like oral drugs and immunotherapy, have the potential to save lives. That will not matter if patients can no longer afford care or if care simply disappears from their community.”

“We are witnessing the dismantling of the best cancer delivery system in the world when the Cancer Moonshot calls for the exact opposite,” said Ted Okon, executive director of COA. “It is no coincidence that this aligns perfectly with the enormous growth of the 340B program and misguided government experiments that continually ratchet down reimbursement. Policymakers should be alarmed at the real world impact D.C. has had on community oncology, and particularly think twice about the proposed CMS Part B experiment on cancer care. This must stop before it is too late. As the Baby Boomers age and the number of survivors increases every year, lives depend on a strong community cancer care system.”

“We are witnessing the dismantling of the best cancer delivery system in the world when the Cancer Moonshot calls for the exact opposite,” said Ted Okon, executive director of COA. “It is no coincidence that this aligns perfectly with the enormous growth of the 340B program and misguided government experiments that continually ratchet down reimbursement. Policymakers should be alarmed at the real world impact D.C. has had on community oncology, and particularly think twice about the proposed CMS Part B experiment on cancer care. This must stop before it is too late. As the Baby Boomers age and the number of survivors increases every year, lives depend on a strong community cancer care system.”

Previous Practice Impact Reports

2016 COA Practice Impact Report

2016 Community Oncology Alliance Practice Impact Report

Since 2010 the Community Oncology Alliance (COA) prepared a Community Oncology Practice Impact Report, tracking the changing landscape of oncology practices in the United States.

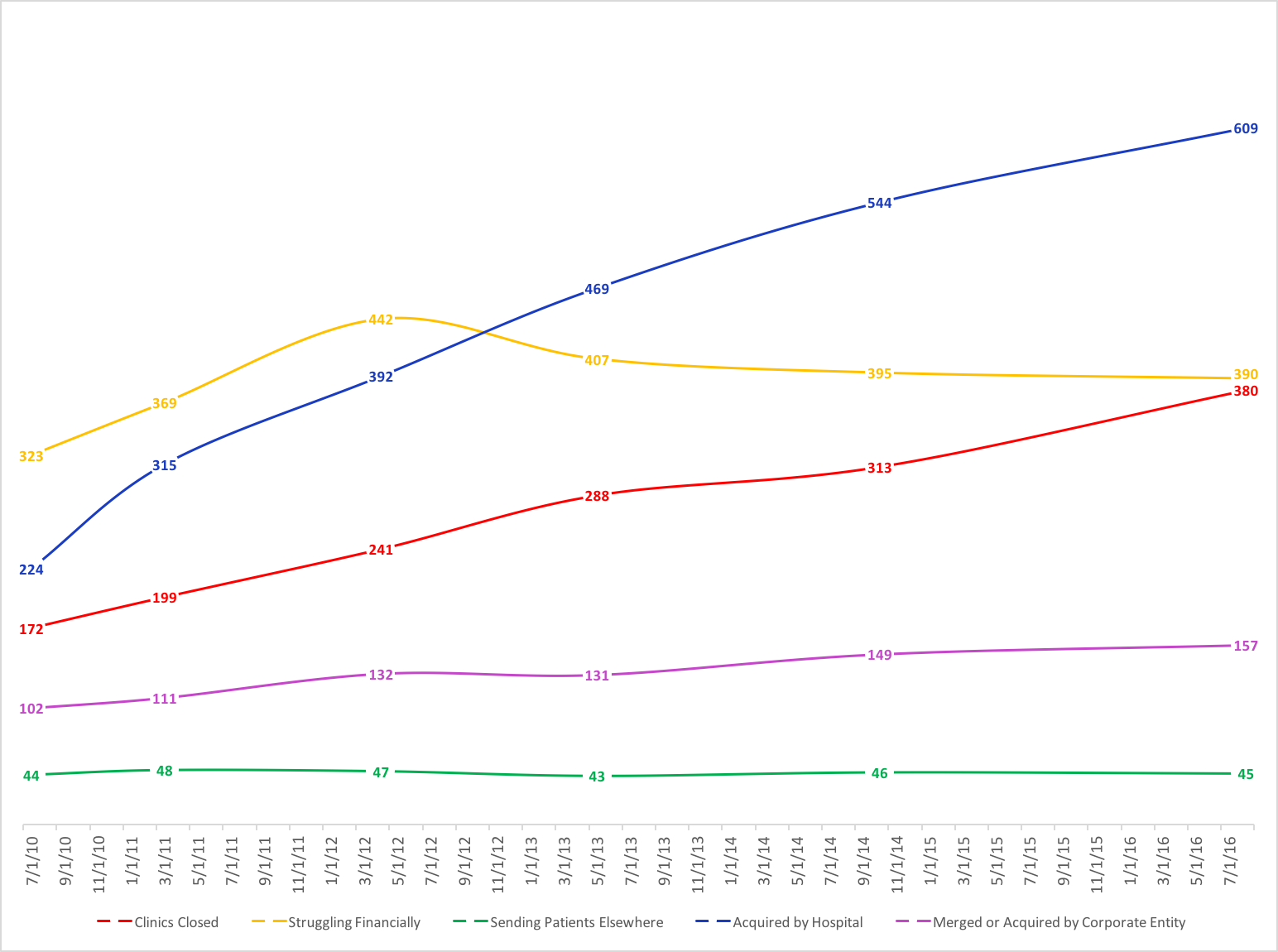

The 2016 Community Oncology Practice Impact Report documents a 121% increase in community cancer clinic closings and a 172% increase in consolidation into hospitals since 2008. In that period, 380 cancer treatment facilities have closed, and 609 community cancer practices have been acquired by or become affiliated with hospitals. Another 390 practices report that they are struggling to stay open due to financial stresses.

This is the sixth Community Oncology Practice Impact Report in the series and covers activity for a nine-year period, from January 2008 through September 2016. It notes that the monthly rate of community oncology practice closures has increased 87% since the previous practice impact report.

Compiled from public and private data sources, the 2016 Practice Impact Report provides a unique look at community oncology trends at both the national and state level. Examining local trends in states, the report shows that the largest number of community oncology practice closures have been in Florida (37), Texas (36), and Michigan (34). The states with the most practices struggling financially are Michigan (43), New York (41), and California (40). Detailed data for all states is included in the report.

Regions Map

Map with Coordinates

The Data

The 2016 Community Oncology Practice Impact Report shows that since 2008, 1,581 community clinics and/or practices nationally have been affected by closings, hospital acquisitions, and corporate mergers. This is a rate of 15.1 community practices affected per month during the observed period. Specifically, the data show:

- 380 Clinics closed — Denotes individual clinic treatment sites that have closed.

- 390 Practices struggling financially – Practices (typically comprised multiple clinic sites) that have had financial difficulties, struggling to pay bills and/or stay open.

- 45 Practices sending patients elsewhere – Practices (typically comprised multiple clinic sites) that are sending ALL of their Medicare patients elsewhere for chemotherapy.

- 609 Practices acquired by hospitals – Denotes practices (typically comprised of multiple clinic sites) that have been acquired by a hospital or, with less frequency, have entered into a contractual professional services agreement binding them to a hospital.

- 157 Practices merged or acquired – Practices (typically comprised multiple clinic sites) that have merged or been acquired by a corporate entity.

Notably, the 2016 Community Oncology Practice Impact Report shows an increasing number of practice closures since the last practice impact report. The annual rate of closures has increased 87% since the last report. Other trends COA notes since 2008:

- 121% increase in clinics closed.

- 21% increase in practices struggling financially.

- 2% increase in practices sending patients elsewhere.

- 172% increase in practices acquired by hospitals (or with a hospital agreement).

- 54% increase in practices merged or acquired.

Historical Trend in the Changing Landscape of Cancer Care

(Derived from current and past reports)

Analysis

Consolidation and hospital acquisition place an additional burden on the nearly 20% of Americans living in rural areas. If the only community cancer clinic in the area closes or is acquired by a hospital, local care may no longer be available. A morning treatment evolves into a daylong excursion. Access-limiting consolidation and closures make that scenario increasingly prevalent.

The trend of closures and consolidation of community oncology clinics into the hospital setting has had a significant and permanent impact on patient access to local, affordable cancer care. The most profound effect has been the hospital acquisition of community oncology practices, which has been fueled by the 340B drug discount program. Originally intended to support hospitals serving high numbers of indigent patients, instead, the 340B program has created a profit motive for hospitals to obtain community oncology practices.

Additionally, disparate site payment policies that reimburse hospitals more for the same cancer care they can receive in community practices has contributed to this shift. The result is that patients pay up to 53% more when they receive hospital-based cancer care versus a physician office setting. That cost is borne by both the patient and the system, most often Medicare. In 2014 alone Medicare spending would have been about $2 billion lower if the site of chemotherapy had not shifted to the hospital setting.

Studies by Avalere, BRG, Milliman, and The Moran Group have shown both the higher cost of cancer care delivered in hospital settings and the impact of the 340B drug discount program. It is noteworthy that despite the severe pressures facing community cancer clinics, they lead the way in enhancing the quality of cancer care and controlling costs through new care delivery models, such as the Oncology Medical Home and Oncology Care Model.

COA Comment

“In the nine years since this report was first issued, 1,581 community oncology practices have closed, been acquired, merged or are struggling to stay open. An average of 3.6 practices have closed per month since COA began tracking this data,” said Bruce J. Gould, MD, president and medical director of Northwest Georgia Oncology Centers in Marietta, Ga., and president of COA. “Treatment advances like oral drugs and immunotherapy, have the potential to save lives. That will not matter if patients can no longer afford care or if care simply disappears from their community.”

“In the nine years since this report was first issued, 1,581 community oncology practices have closed, been acquired, merged or are struggling to stay open. An average of 3.6 practices have closed per month since COA began tracking this data,” said Bruce J. Gould, MD, president and medical director of Northwest Georgia Oncology Centers in Marietta, Ga., and president of COA. “Treatment advances like oral drugs and immunotherapy, have the potential to save lives. That will not matter if patients can no longer afford care or if care simply disappears from their community.”

“We are witnessing the dismantling of the best cancer delivery system in the world when the Cancer Moonshot calls for the exact opposite,” said Ted Okon, executive director of COA. “It is no coincidence that this aligns perfectly with the enormous growth of the 340B program and misguided government experiments that continually ratchet down reimbursement. Policymakers should be alarmed at the real world impact D.C. has had on community oncology, and particularly think twice about the proposed CMS Part B experiment on cancer care. This must stop before it is too late. As the Baby Boomers age and the number of survivors increases every year, lives depend on a strong community cancer care system.”

“We are witnessing the dismantling of the best cancer delivery system in the world when the Cancer Moonshot calls for the exact opposite,” said Ted Okon, executive director of COA. “It is no coincidence that this aligns perfectly with the enormous growth of the 340B program and misguided government experiments that continually ratchet down reimbursement. Policymakers should be alarmed at the real world impact D.C. has had on community oncology, and particularly think twice about the proposed CMS Part B experiment on cancer care. This must stop before it is too late. As the Baby Boomers age and the number of survivors increases every year, lives depend on a strong community cancer care system.”

Previous Practice Impact Reports