The Promise of Biosimilars in Cancer Care and Reality of the U.S. Market

Introduction

Biological products, or biologic drugs, have transformed the way patients with many diseases, including cancer, are treated. Some examples of biologics include hormones, blood products, cytokines, growth factors, vaccines, gene and cellular products, fusion proteins, insulin, interferon, and monoclonal antibody products. Biologics are expensive, ranging in cost from tens of thousands of dollars to hundreds of thousands of dollars each year per patient. As biologic drugs lose their patent protection, there exists an opportunity for the introduction of “biosimilar” drugs. A biosimilar is a copy of a biologic medicine that is similar, but not identical, to the original medicine. It may be used in patients who have been previously treated with the reference product, as well as patients who have not previously received the reference product.

A Look at the Data and Evidence to Date

Biosimilar drugs have the potential to provide more treatment options, improve access to lifesaving medications, and lower health care costs through increased competition. All these benefits depend on how many biosimilar drugs are developed, approved, and become available to patients. This paper examines the status of biosimilars in the U.S. health care system, with a focus on biosimilars for the treatment of cancer, and the various obstacles that are slowing their utilization.

Biological products, or biologic drugs, have transformed the way patients with many diseases, including cancer, are treated. Some examples of biologics include hormones, blood products, cytokines, growth factors, vaccines, gene and cellular products, fusion proteins, insulin, interferon, and monoclonal antibody products. Biologics are expensive, ranging in cost from tens of thousands of dollars to hundreds of thousands of dollars each year per patient. As biologic drugs lose their patent protection, there exists an opportunity for the introduction of “biosimilar” drugs. A biosimilar is a copy of a biologic medicine that is similar, but not identical, to the original medicine. It may be used in patients who have been previously treated with the reference product, as well as patients who have not previously received the reference product.

U.S. Biologics and Biosimilars Market

Biologic drugs represent an expensive and rapidly growing segment of pharmaceutical drug spending due to the high costs associated with their development and manufacturing. In 2019, the U.S. spent $493 billion on medicines, including $211 billion on biologics—43% of total medicine spending.1 As a segment of the pharmaceutical drug market, biologics spending grew at a rate of 14.6% over the past five years compared to the total drug market growth rate of 6.1% (small molecules, biologics, and biosimilars), according to IQVIA.1

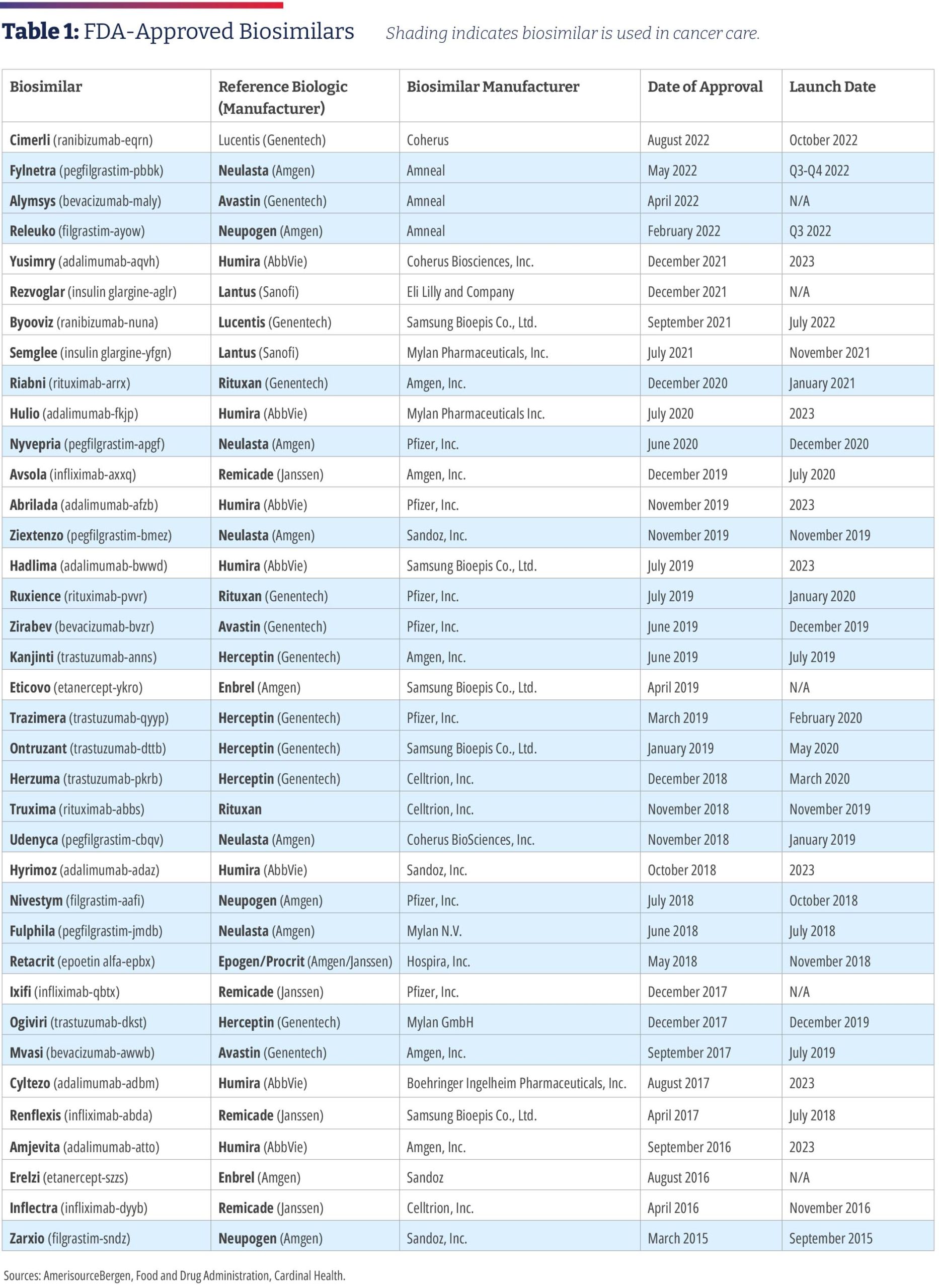

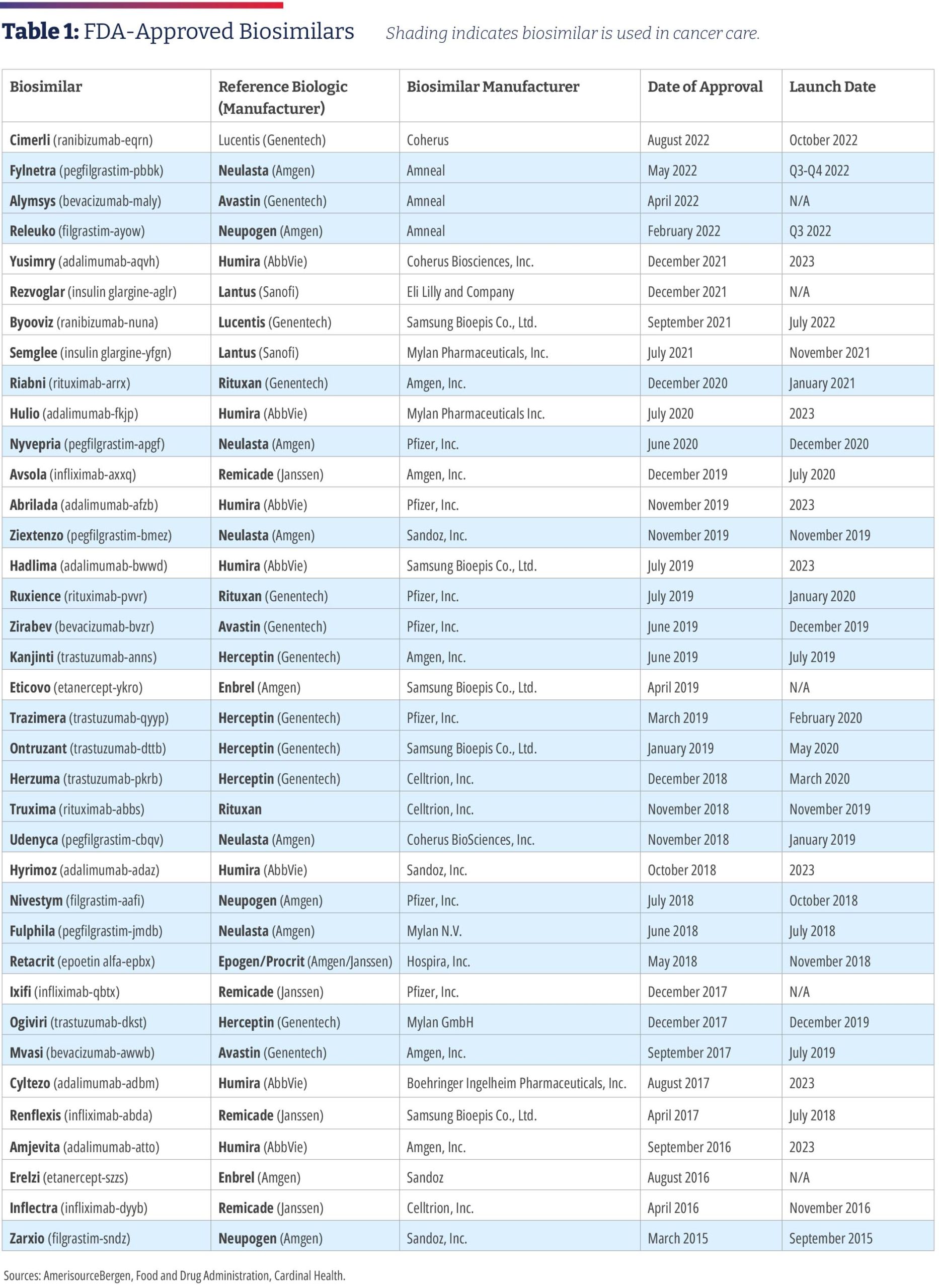

In 2015, Zarxio [filgrastim-sndz, Sandoz] became the first biosimilar to be approved by the Food and Drug Administration. Zarxio is biosimilar to Amgen’s Neupogen, a myeloid growth factor used to treat neutropenia caused by chemotherapy or radiotherapy to treat cancer. As of August 4, 2022, there are 37 approved biosimilars (see Table 1) and 22 launches, with the majority for the treatment of cancer or supportive therapy. There are now multiple approved biosimilars of rituximab [Rituxan, Genentech], trastuzumab [Herceptin, Genentech], and bevacizumab [Avastin, Genentech]; in the supportive therapy category, there are multiple biosimilars for filgrastim, pegfilgrastim [Neulasta, Amgen], and a biosimilar for epoetin alfa [Epogen/Procrit, Amgen/Janssen]. Outside of oncology, there are biosimilars for insulin, TNF (tumor necrosis factor) blockers for the treatment of autoimmune diseases, as well as ranibizumab [Lucentis, Genentech] for macular degeneration, which launched in June.2

In July 2021, the FDA approved the first interchangeable biosimilar, Semglee [insulin glargine-yfgn, Viatris], which is biosimilar to the long-acting insulin Lantus [Sanofi].3 It is the first biosimilar in diabetes care, and since it is primarily dispensed at retail pharmacies, it is billed under the pharmacy benefit. Cyltezo [adalimumab-adbm, Boehringer Ingelheim], initially approved in 2017 as a biosimilar to Humira, was approved as the first interchangeable product referencing adalimumab in October 2021, making it the second interchangeable product approved by FDA.4 Cyltezo won’t be marketed until July 1, 2023, because of a patent settlement agreement, and not all of the drug’s indications will be included on Cyltezo’s label because of existing marketing exclusivity.5 In August 2022, the FDA approved the first biosimilar interchangeable with ranibizumab [Lucentis, Genentech].2

At least five more biosimilars are scheduled to enter the U.S. market in 2023 as biosimilar versions of adalimumab, which is used to treat rheumatoid arthritis, Crohn’s disease, ulcerative colitis, and several other conditions. These launches are the result of patent settlements allowing the biosimilars to enter the market before the expiration of patents on the reference biologic. Litigation is ongoing between the manufacturer of Enbrel [Amgen], used to treat arthritis, psoriasis, and other conditions, and biosimilar manufacturers, blocking Erelzi [etanercept-szzs, Sandoz] and Eticovo [etanercept-ykro, Samsung Bioepis] from coming to market.6

There are 97 biosimilar development programs underway.7 In addition to oncology, supportive care, and rheumatology, therapeutic areas in which biosimilars are being developed include ophthalmology, fertility, growth hormone, immunosuppressants, and long- and short-acting insulin.2

Biosimilars Help Reduce Health Care Costs, Including Cancer Treatment

The National Cancer Institute estimates that cancer-related direct medical costs in the U.S. were $183 billion in 2015 and are projected to increase to $246 billion by 2030, a 34% increase based only on population growth and aging. However, the projection is likely an underestimate because of the increasing costs of medicines to treat cancer, including biologics.8,9

The prescribing of biosimilars saved the U.S. health care system $7.9 billion in 2020, more than tripling the $2.5 billion saved in 2019, according to the Association for Accessible Medicines (AAM), the trade association of generic and biosimilar manufacturers.6 Use of lower cost biosimilars has provided $12.6 billion in savings since 2011.6 Savings as a result of biosimilars has been estimated between $85 billion and $133 billion in aggregate by 2025.1

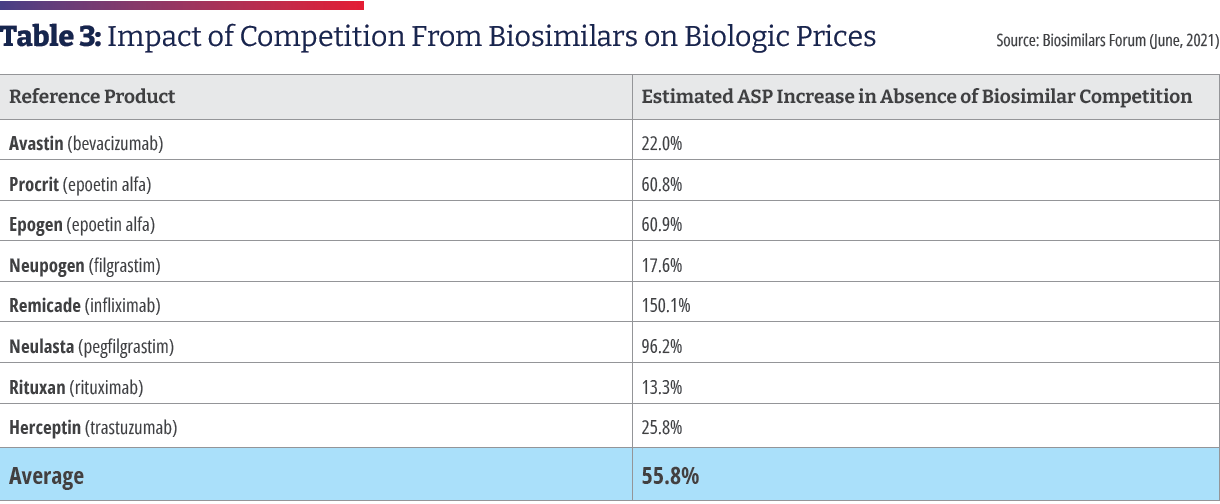

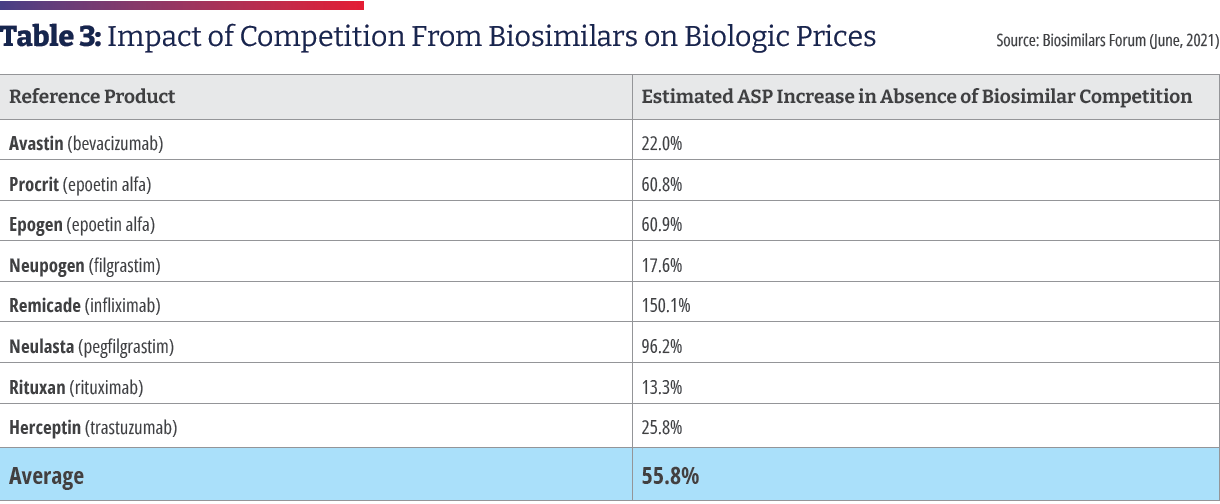

The average price discount of biosimilars within each molecule type averages 30% less than their reference brand biologic.1 Biosimilars also help keep prices in check for reference biologics. Xcenda examined the average sales price (ASP) of brand name reference biologics beginning two years before the first biosimilar competitor for each reference biologic entered the market. They tracked the trended ASP of the brand name reference biologics and the first biosimilar that became available to determine how the introduction of biosimilar competition affects the ASPs for brand name reference biologics. The report found that every brand name biologic was on track to have a higher ASP in the absence of biosimilars with an ASP estimated to be 56% higher without biosimilar competition.10

Biosimilars Are Not Generics

Biosimilar drugs may be likened to generic drugs in that they are versions of brand name drugs whose patent has expired. Biosimilars and generics are approved through abbreviated regulatory pathways that avoid duplicating costly clinical trials. However, biosimilars are not generics and there are important differences between biosimilars and generic drugs.1

Generic drugs are made from small molecules and are chemically synthesized as identical equivalents to the reference product. Generic drug makers use the exact same process as the brand name manufacturer and the product has the same active ingredients, strength, dosage, and route of administration as the reference product. Although generic manufacturers are not required to test their products in clinical trials, the FDA conducts a rigorous pre-approval review to ensure generics have the same quality and efficacy as the branded product. Because the active ingredients in the generic product are identical to its brand-name counterpart, it can be substituted at the pharmacy.2

The Drug Price Competition and Patent Term Restoration Act (Public Law 98-417) of 1984, known as the Hatch-Waxman Act, encouraged the manufacture of generic drugs and outlined the process for pharmaceutical manufacturers to file an Abbreviated New Drug Application (ANDA) for approval of a generic drug by the FDA.3 Before the Hatch-Waxman Act, only 19% of prescriptions in the U.S. were generics, whereas today generics comprise approximately 90% of the market.4

In contrast, biological products are created from large complex molecules produced through biotechnology in a living system, such as a microorganism, plant cell, or animal cell, thus making an identical copy impossible. Since the process of making a biologic drug cannot be replicated exactly, a biosimilar is created that is highly similar to the original biologic.6 In fact, no two biological products can be identical.7

In 2010, Congress passed the Biologics Price Competition and Innovation Act (BPCIA) as part of the Patient Protection and Affordable Care Act, creating an abbreviated licensure pathway for biological products that are demonstrated to be biosimilar to, or interchangeable with, an FDA-approved biological product. This pathway was established as a way to encourage biosimilar competition and reduce drug spending on expensive brand-name biologics, similar to the way Hatch-Waxman Act fostered the use of generics.8

- http://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

- NCSL LegisBrief, 01-2022, PDF p 2, col 1, para 1-2

- Mossinghoff Food Drug law J., 1999; 54(2):187-94

- NCSL LegisBrief, 01-2022, PDF p 2, col 2, para 6

- NCSL LegisBrief, 01-2022, PDF p 2, col 1, para 3

- Morrow T, et Biotechnol Healthc, 2004; 1(4):24-29

- http://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

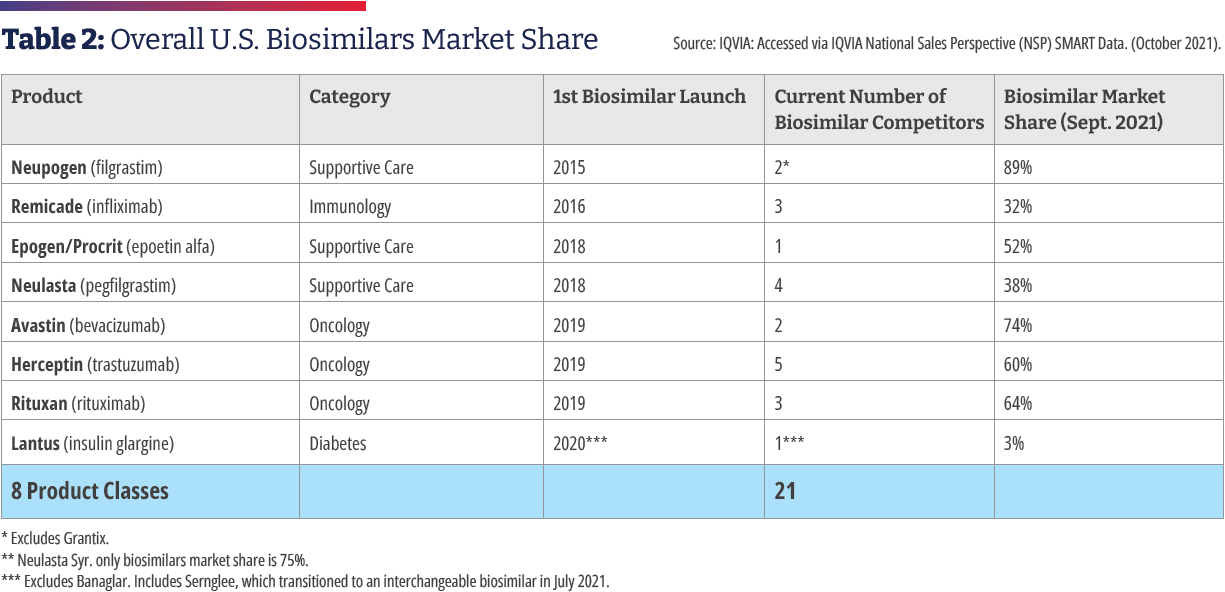

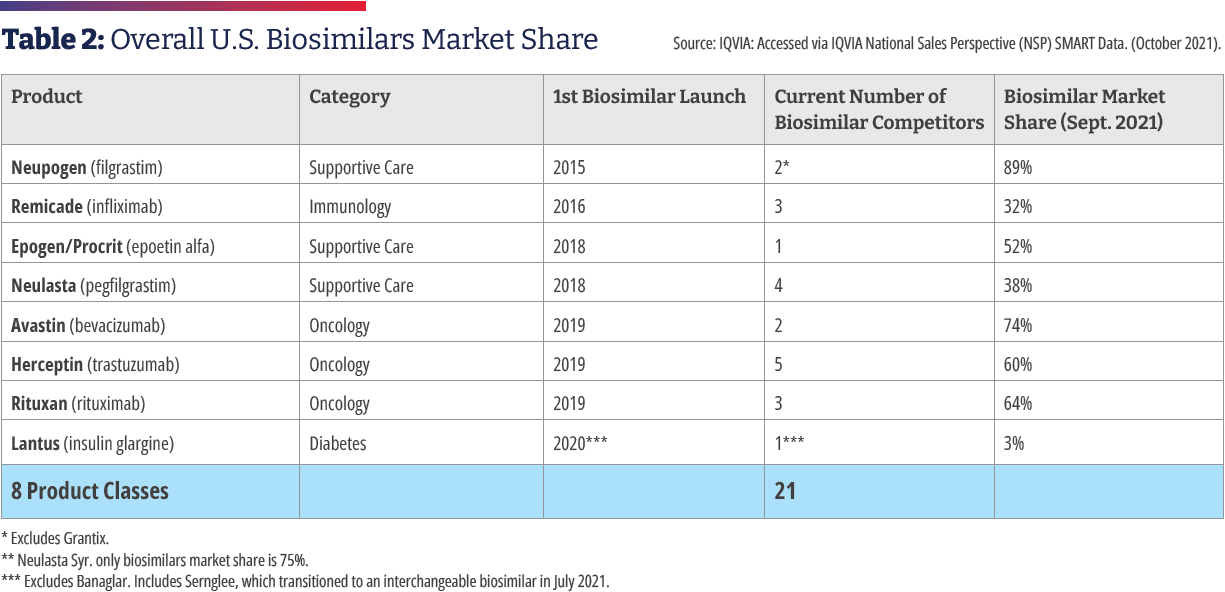

The significant growth in biosimilars savings has been primarily driven by oncology biosimilars bevacizumab, rituximab, and trastuzumab. These therapies were launched in late 2019 and quickly progressed to 74%, 64%, and 60% market share respectively at a significant discount relative to their reference products.6 The savings resulting from the use of biosimilars in the treatment of cancer is being documented in a growing body of medical literature. One study examined the effect of gradually shifting patients to Zirabev [bevacizumab- bvzr, Pfizer] biosimilar over five years. Assuming an annual market shift of 1.7%, 3.5%, 6.7%, and 11.9% to bevacizumab- bvzr, an annual cost savings of $313,363 was estimated for a commercial payer and $92,880 for Medicare in Year 1. Cumulative five-year cost savings were $7,030,924 for a commercial payer and $4,059,256 for Medicare. More than half of the cost savings was attributed to patients with metastatic colorectal cancer.11As a direct result of biosimilar competition, oncology spending growth declined from about 16% in 2018 to 10% in 2020, and it is projected to decline further, helping control oncology spending in the years ahead, even as the new higher-priced oncology drugs come to market.12

Oncologists Have Embraced Biosimilars

Medical societies representing oncologists have endorsed the use of biosimilars. In 2019, the Community Oncology Alliance (COA) released a position statement saying that it will work with stakeholders to support the acceptance of biosimilars by educating oncologists.13 In October 2020, the American Society of Clinical Oncology (ASCO) published an update to its guideline on treating early-stage breast cancer in which it endorsed the use of biosimilar trastuzumab.14 Last year, the National Comprehensive Cancer Network (NCCN) Oncology Research Program announced it was collaborating with Pfizer Inc. to fund 10 projects to improve processes related to biosimilar adoption in oncology.15 Earlier this year, an ASCO expert panel supported the inclusion of FDA-approved biosimilars in clinical practice guidelines.16 The American Cancer Society’s annual “Costs of Cancer” report detailed how a patient with breast cancer underwent drug therapy spanning multiple years. The brand-name biologic drug would have cost $74,487, but the biosimilar version was $58,906 yielding the patient and her insurer/employer a savings of 21%.17

Cardinal Health has been conducting research about biosimilars with oncologists since 2015 to assess their familiarity and understanding of biosimilars and to identify concerns and barriers that might impede adoption. Results of surveys conducted during the 2020-2021 time period include the following:

- 53% of oncologists surveyed described themselves as very familiar and 39% described themselves as somewhat familiar with Only 6% said they were “not very familiar.”

- When asked for which patients they would most likely prescribe a biosimilar, 67% said new patients, and 67% said existing patients having success on a reference product, with 27% saying existing patients having limited success on a reference product.

- More than nine in 10 participating oncologists said they were comfortable prescribing a biosimilar with an FDA approval based on extrapolation. Only 5% of participating oncologists said they would not prescribe biosimilars for indications without clinical trial data.

- More than seven in 10 participating oncologists said they are “very” or “moderately” comfortable with automatic substitution of biosimilars.

- Since 2015, acceptance of interchangeability has evolved from 22% in 2017 to nearly 100% for some indications in 2021.

- Participating oncologists said they felt comfortable switching patients to biosimilars for both curative and palliative intent.

- More than 90% of participating oncologists said they are comfortable switching between biosimilars in at least some cases.

- 68%, 62%, and 67% of oncologists had prescribed biosimilars to trastuzumab, bevacizumab, and rituximab, respectively in the past year.18

In 2020, Texas Oncology, a large community practice, converted to biosimilars using a physician-approved pharmacist-driven, care-team approach. From January to December, the practice increased utilization of biosimilars for rituximab from 5% to 80%, bevacizumab from 9% to 88%, and trastuzumab from 8% to 74%. Estimated cost savings per dose-based average sales price were $550 for bevacizumab, $850 for trastuzumab, and $1,400 for rituximab. With using biosimilars for the three drugs alone, the practice has surpassed 85% biosimilar usage. In one month, the use of the three biosimilars reduced costs 21% or $4 million.19

An analysis of real-world prescribing found rapid uptake of biosimilars among oncology providers between 2019 and 2021, according to an abstract at ASCO’s 2021 conference. The study authors reported that in the three months following the 2019 launch of trastuzumab’s first biosimilar, trastuzumab-anns [Kanjinti, Amgen], 7.3% of initiating first-line patients were prescribed the biosimilar over the reference product. During the same period in 2020, when a total of five trastuzumab biosimilars were available, 80.5% of initiating first-line trastuzumab patients began treatment on a biosimilar. This differed by product with the initial uptake for the first rituximab biosimilar, rituximab-pvvr [Ruxience, Pfizer], at only 2.3%. The study also revealed that oncologists were willing to switch patients to a biosimilar: 11.1% of all patients (bevacizumab: 11.3%, trastuzumab: 14.1% and rituximab: 7.9%) switched from a reference product to a biosimilar during treatment. Among patients on trastuzumab at the time of its first biosimilar launch, 18.2% switched to trastuzumab-anns in the first 90 days post-launch. Costs per prescription were significantly lower for biosimilars, 42%, 29.9% and 89.5%, relative to the reference products for trastuzumab, rituximab, and bevacizumab, respectively.20

A study of community oncology practices found a dramatic increase in the adoption of biosimilars for bevacizumab and trastuzumab, which were first marketed in July 2019. In the fourth quarter of that year, participating practices reported 8,000 administrations of bevacizumab vs. 21,000 for the reference product, representing a 29% share of administrations for biosimilar bevacizumab. By the fourth quarter for 2020, bevacizumab biosimilars had achieved a 72% share of the administrations, or roughly 31,000 in total and 18,000 for bevacizumab biosimilars vs. 13,000 for the reference product. In the fourth quarter of 2019, trastuzumab biosimilars accounted for about 8,000 administrations vs. 16,000 for the reference product, representing a 35% share of administration for biosimilar trastuzumab. The biosimilar share grew to 79% of administration by the fourth quarter of 2020 (65,000 biosimilar administrations vs. 29,000 reference product administrations, roughly). Other biosimilars used in oncology also saw gains from inception to the fourth quarter of 2020, including rituximab [Rituxan, Genentech], infliximab [Remicade, Janssen] and pegfilgrastim [Neulasta, Amgen].21

Value-Based Care Drives Biosimilar Adoption

Oncology practices participating in the Oncology Care Model (OCM) were early adapters of biosimilars. Initiated by The Centers for Medicare and Medicaid Services (CMS), the OCM pilot involved approximately 175 practices and 14 payers that were incentivized to transform their practices from volume-based to value-based and provide more efficient and cost-effective care under Medicare. Jeffrey Patton, MD, the CEO of OneOncology, Chairman of the Board of Tennessee Oncology, and member of the COA Board of Directors, told Biosimilar Development: “It just makes sense. If you’re in this program where you have the opportunity for shared savings, you want to work towards lowering the total cost of care and saving money. Biosimilars will be a critical driver for us to generate savings in Medicare, and once we hit a certain threshold, a portion of those savings will be shared with our clinics.” Biosimilar Development concluded that oncologists’ experience with biosimilars may serve as a model for clinicians treating patients in other therapeutic areas where biosimilars become available.22 Further, value-based initiatives, such as the OCM and its announced successor the Enhancing Oncology Model (EOM), could serve as models for establishing incentives for biosimilar adoption.23,24

Biosimilar Uptake Has Been Slower Than Expected

Despite a progressive development program and documented costs savings, biosimilar adoption in the U.S. has occurred more slowly than that of Europe, which was 10 years ahead of the U.S. IQVIA estimates a 30% biosimilar share of volume is achieved in the first 24 months after the U.S. launch of a biosimilar along with a 30% reduction compared to the originator drug.1 In contrast, in Europe, biosimilars are at a 50% or greater adoption across the continent, and pricing of biosimilars is sharply down—at least 50% for the biosimilars and reaching 70% to 80% (with EU prices starting lower, at approximately 35% of U.S. prices).25

The reasons why the U.S. is behind Europe in biosimilar adoption include Europe’s national health systems with centralized decision making, which allows them to make these products available to prescribers and patients as soon as they are approved, whereas in the U.S., not all approved biosimilars have launched due to patent litigation. At a national level, European governments create incentives for prescribing and taking biosimilars, since the payment/reimbursement is centrally controlled and consistent throughout the country.26 A report by ICON attributed the more robust European biosimilar uptake to a different patent landscape, the absence of an interchangeability designation, and the U.S.’ fragmented health system in which payers are driven by pricing and manufacturers’ rebates.27

Obstacles to Biosimilar Adoption in the U.S.

Payer coverage for biosimilar treatments has improved greatly over the last two years, according to Cardinal Health, yet providers continue to face familiar obstacles.18 Some payers require the reference product, and others prefer the reference product so that the reference product must be used prior to the patient trying a biosimilar for that product.28,29 Formularies that stipulate providers use only the reference product or one specific biosimilar present an operational challenge to practices. Because practices must accommodate the formularies of a variety of regional and/or national payers, each clinic must stock all the required formulary products, which requires inventory management, electronic health record maintenance, and expanded administrative duties, including increased prior authorizations. If a non-formulary product is administered, the clinic has to absorb the cost.30 Drug coverage and payer policies may change multiple times in a given year, which means patients may be switched to a new biosimilar product multiple times a year.

In a survey of 52 practices, COA found the following payer restrictions on biosimilar use:

- 44% reported that at least one payer requires them to use a reference product instead of a biosimilar.

- 59% said they are required to stock multiple biosimilars for the same drug because different payers have different formulary requirements.

- 37% are required to follow payer step therapy requirements before they can use a practice’s preferred biosimilar 21

Biosimilars Are as Safe and Effective as Their Reference Biologics

The BPCIA specifies that a manufacturer developing a proposed biosimilar must demonstrate that its product is “highly similar” to and has “no clinically meaningful differences” from the reference product in purity and potency, efficacy, and safety. This is generally demonstrated through human pharmacokinetic and pharmacodynamic studies, an assessment of clinical immunogenicity, and, if needed, additional clinical studies.1 Other factors that are the same between a biosimilar and its reference brand product include the route of administration, the strength and dosage form and the potential side effects.1

There is a separate regulatory process in which a biosimilar may be designated “interchangeable” with an FDA-approved biological product. An interchangeable biosimilar product meets additional requirements to show that it is expected to produce the same clinical result as the brand name or “reference” product in any given patient. Also, for products administered to a patient more than once, the risk in terms of safety and reduced efficacy of switching back and forth between an interchangeable product and a reference product will have been evaluated. Biosimilars that are interchangeable may be substituted for the reference product without consulting the prescriber, subject to state law, similarly to the way a pharmacist may substitute a generic drug for a brand name drug when filling a prescription.1

In 2021, President Biden’s Executive Order Promoting Competition in the American Economy directed the U.S. Department of Health and Human Services “to increase support for generic and biosimilar drugs, which provide low-cost options for patients.” The order contained provisions encouraging the FDA and FTC to prohibit certain anticompetitive practices that impede the entry of biosimilars to the market.2 Advocates believe policy changes will be required to remove incentives for using more expensive treatment options if biosimilars are to fulfill their potential.

- Biosimilars. March 8, 2022. https://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

- FACT SHEET: Executive Order on Promoting Competition in the American Economy. July 9, 2021. https://www.whitehouse.gov/briefing-room/statements-releases/2021/07/09/fact-sheet-executive-order-on-promoting-competition-in-the-american-economy/

Rebates Push PBMs to Select More Expensive Drugs

Although biosimilar drugs are generally priced lower, stakeholder incentives are not always aligned to enable or support biosimilar adoption.18 Pharmacy benefit managers (PBMs) are companies that manage pharmacy benefits for health insurers, Medicare Part D drug plans, large employers, and other payers. As PBMs use their purchasing power to negotiate with drug manufacturers, they often receive rebates and discounts that are calculated as a percentage of the manufacturer’s list price. Brand manufacturers can compete by increasing their rebates to encourage payers to maintain a preference for the brand biologic on their formulary.31 Although the PBM’s role is to control drug spending, the manufacturer that provides the largest rebate wins the preferred product slot on the formulary, even if the drug is more expensive than other options, such as a biosimilar. As a result, patients who have a high-deductible plan or have copays based on a drug’s list price may incur higher out-of- pocket costs.32

Kaiser Permanente uses an evidence-based approach to its formulary and the biosimilar adoption process. It also declines to accept rebates, and, as a result, its biosimilar utilization is high. Sameer Awsare, MD, associate executive director of The Permanente Medical Group, has described how their physicians questioned the results of the European studies of Zarxio, the first biosimilar to receive approval in the U.S. Kaiser performed a study with its own patients and found less neutropenia than with the reference drug Neupogen. As a result, Kaiser Permanente had 98% uptake of Zarxio in 2019, followed by high uptake of biosimilars to infliximab, trastuzumab, bevacizumab, and rituximab.33,34 Since Kaiser Permanente manages its own formulary—it operates as its own payer and has its own medical groups employing 23,000 physicians and 60,000 nurses and staff taking care of 12.3 million patients—it is protected from the middlemen, such as PBMs, that drive up the cost of health care.

340B Hospitals Are Slow to Adopt Biosimilars

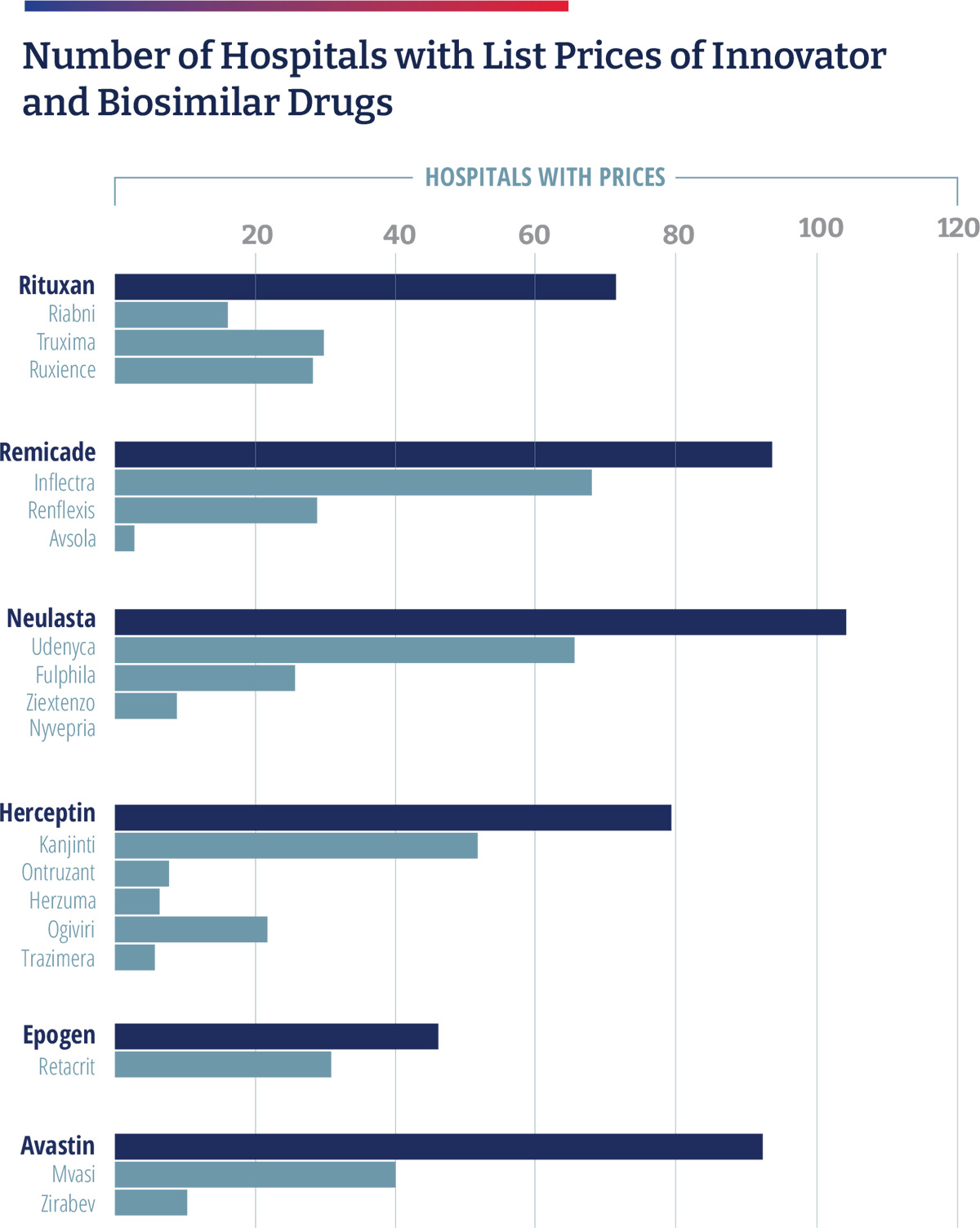

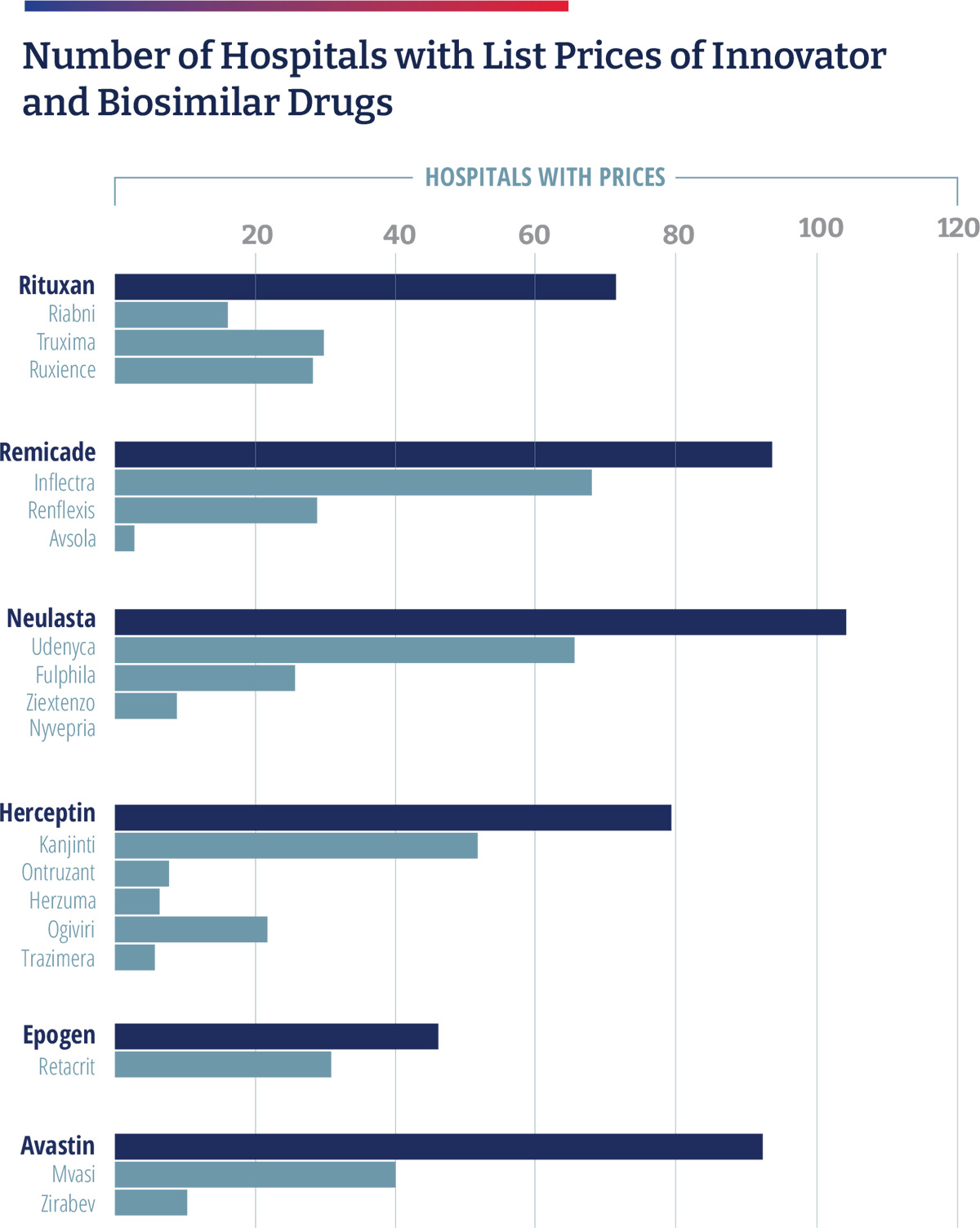

An analysis of disproportionate share hospitals participating in the 340B Drug Pricing Program, commissioned by COA, and conducted by Aharon (Ronny) Gal, PhD, found that 340B hospitals have been slow to embrace biosimilars as these hospitals profit from the use of higher cost drugs. As part of the Affordable Care Act, hospitals participating in the 340B drug program are required to publish their standard charges. In 2019, CMS revised its guidance to require hospitals to publish a “machine-readable” file containing prices for all “items and services” provided by the hospital to patients for which the hospital has established a standard charge, including maximum negotiated prices, as well as payer-specific negotiated charges, which is the rate that a hospital has negotiated with each third-party payer.

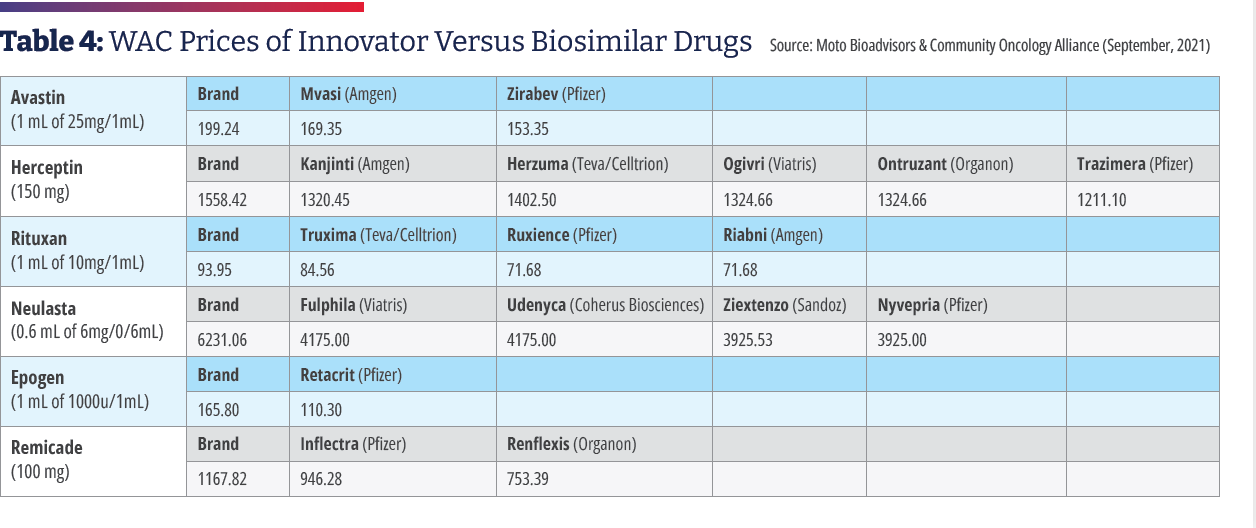

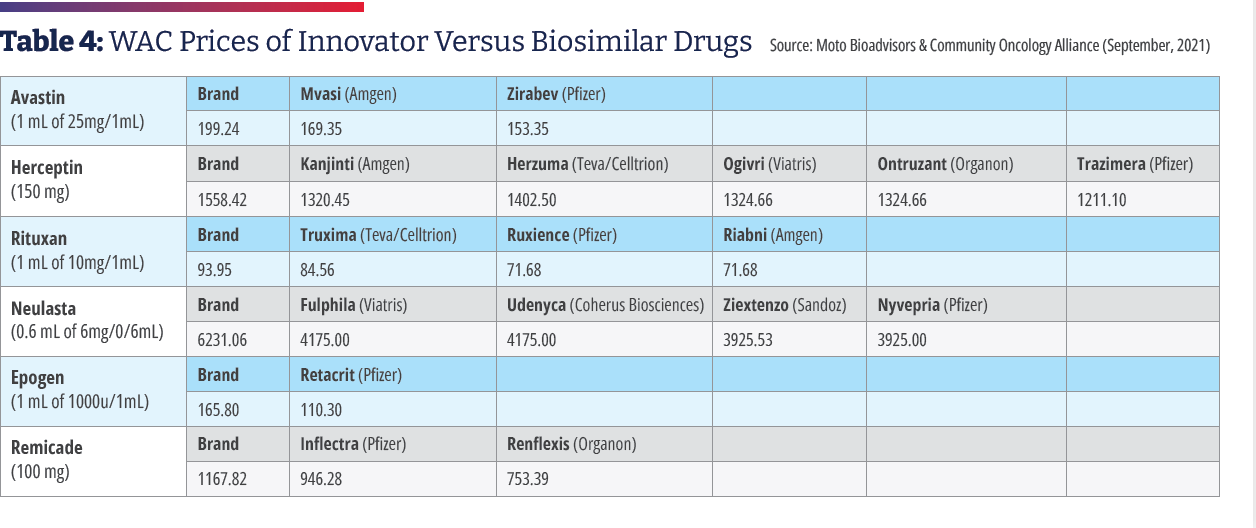

Of the 1,087 acute care 340B hospitals, 890 provided a price transparency file of which 876 were in a readable form; 233 included drug prices; and 123 included individual plan names. Gal noted that 340B hospitals tend to price drugs at a mark-up to their wholesale acquisition cost (WAC) price and retain that price, even if manufacturer prices decline, and most biosimilars establish their WAC prices at a discount to the WAC price of the reference drug to compete in the non-hospital segment. As a result, 340B hospitals have an incentive to prefer reference products because, for the same net-price level, they pocket higher profits. Gal found that 340B hospitals marked up drugs at a median rate of 3.8 times the 340B hospital-discounted acquisition cost. Compared to WAC, drug charges were typically two to three times higher. He found a five-times gap between hospitals’ average allowable charges, and a two- to three-times spread in allowable charges within the same hospital for the same drug. He also found that between 25% and 46% of the hospitals listed prices for only the innovator product and essentially none carried all the biosimilars. There were only a handful of hospitals where only the biosimilars are listed.35

Although biosimilar drugs are generally priced lower, stakeholder incentives are not always aligned to enable or support biosimilar adoption.

Reform Needed for Medicare to Increase Biosimilar Adoption

Another obstacle hindering biosimilar adoption is Medicare’s reimbursement rules, which do not incentivize clinicians to prescribe lower cost drugs, such as biosimilars, and actively reward the prescribers of higher priced drugs. For patients with Medicare, drugs that are administered by clinicians in an outpatient hospital or clinic setting are reimbursed under Medicare Part B, and spending has been growing due to the introduction of expensive drugs, such as biologics. In 2018, the Medicare program and its beneficiaries spent roughly $35 billion on drugs paid through Part B. From 2009 through 2018, Part B drug spending grew at an average of 12%.36

Medicare pays providers for newly launched physician- administered outpatient drugs at WAC plus 3%. Once the new drug has been assigned a unique Medicare billing code, Medicare reimburses providers the ASP plus 6% (reduced to 4.3% by the budget sequester). The switch to payment based on ASP is intended to allow Medicare to share in some of the volume discounts manufacturers give to providers outside of the 340B program.36 This process means that, even if prices fall for one biosimilar product, the prices of the originator biologics and other biosimilars can remain high. This arrangement limits direct price competition and provides an inverse incentive for clinicians to administer the highest-cost product to obtain the greatest reimbursement from Medicare.37 Not surprisingly, a recent study found minimal uptake of biosimilars and limited price reductions for biologics and biosimilars under the current Medicare Part B reimbursement policy whereas there have been steep declines in generic drug costs. If biologics and biosimilars were subject to the same Medicare reimbursement framework as brand-name and generic drugs, Medicare spending on these products was estimated to have been 26.6% lower or $1.6 billion from 2015 to 2019.38

Medicare Part D Plans Favored Biologics Over Less Expensive Biosimilars

Biologics that are self-administered by patients and distributed through retail pharmacies are covered by Medicare Part Spending has been growing due to the introduction of expensive drugs, such as biologics, which are estimated to cost Part D upwards of $12 billion annually.39 Like commercial payers, Part D plans may implement utilization management tools, including prior authorization and step therapy, which requires beneficiaries to first try a less expensive drug before moving to a more expensive drug. They also may negotiate rebates from drug manufacturers in exchange for encouraging greater utilization of a manufacturer’s drug, such as placing their drugs on preferred formulary tiers with lower beneficiary cost-sharing or for exclusive coverage of their drugs. A manufacturer’s rebates for biologic reference products may be high enough that they reduce the cost of these products so much that the biosimilars are more expensive for the Part D plan than their reference products while not directly lowering Part D drug costs for beneficiaries.40

The Office of the Inspector General (OIG) for HHS analyzed biosimilar utilization and spending in Part D from 2015 to 2019 and found that Part D spending on biologics with available biosimilars could have decreased by $84 million or 18%, “if all biosimilars had been used as frequently as the most used biosimilars.” Additionally, beneficiaries’ out-of-pocket costs for these drugs could have decreased by $1.8 billion, or 12%. “Although these amounts are modest in the context of overall Part D spending, far greater spending reductions will be possible as additional biosimilars become available,” the OIG concluded.39 To help ensure that Part D and its beneficiaries can capitalize on potential savings, the OIG recommended that CMS encourage plans to increase access to, and use of, biosimilars in Part D and specifically recommended that CMS conduct a demonstration project to determine whether capped copayments increase the use of lower-cost biosimilars. The OIG also recommended that CMS monitor biosimilar coverage on formularies to identify concerning trends, such as Part D plan formularies that exclude biosimilars, place biosimilars on less preferential tiers than their reference products, or employ stricter utilization management policies— such as prior authorization and step therapy—for biosimilars than for their reference products.39 CMS concurred with the OIG’s first recommendation but neither concurred or “nonconcurred” with its second recommendation.39

Biosimilars Can Reduce Health Care Costs for Employers

The escalating costs of specialty drugs, often biologics, present a challenge for employers trying to control health care costs. For example, Dean Foods, a leading food and beverage company with 15,000 employees, turned to biosimilars after realizing that specialty drugs used by 2% of plan members accounted for one third of the company’s overall drug spend. The company carved out all specialty drugs from its PBM and carrier. Instead of spending $227,500 in 2019 on three biologic drugs, the company spent $52,900 on four biosimilars. Conversions to biosimilars was only one component of its specialty drug savings program, and it yielded significant savings of $174,600 (77%).41

Despite success stories such as that of Dean Foods, the National Alliance of Healthcare Purchaser Coalitions (National Alliance) reported that employers have received conflicting and erroneous information from health plans, PBMs, benefits consultants, providers, and pharmacists about biosimilars. Information such as biosimilars are more expensive and less safe than their branded counterparts and an unnecessary addition to the formulary.26

Interchangeability

A common misperception is that interchangeable biosimilars must meet higher standards for approval than non- interchangeable biosimilars. To obtain the interchangeable designation, biosimilar manufacturers are required to meet additional requirements, namely switching studies to assess the safety of switching between a reference product and biosimilar multiple times.18 However, all biosimilars —whether interchangeable or not—undergo rigorous and thorough evaluations to ensure safety and effectiveness to meet the FDA’s high standards for approval. Without interchangeability, prescribers must choose a specific biosimilar by name and pharmacists cannot substitute biosimilars automatically, which limits the potential for biosimilars to be adopted and compete on price with the reference biologics.42 While some payers and providers decide to wait for interchangeable biosimilars, potential costs savings are lost.

A common misperception is that interchangeable biosimilars must meet higher standards for approval than non- interchangeable biosimilars.

Conclusion

Biosimilars offer potential benefits to society, payers, providers, and patients. In addition to lowering spending by offering a potentially lower-cost treatment option, the competition fostered by the introduction of biosimilars may lead to savings that can be redeployed toward spending on new innovative therapies.43 Some advocates have cited knowledge gaps and unfamiliarity among clinicians as a factor inhibiting broader use of biosimilars, but research has shown growing adoption of biosimilars by oncologists when their use is covered by payers. As coverage of biosimilars improves by commercial insurers, biosimilar uptake is expected to increase, making the promise of biosimilars a reality. Many health care advocates believe 2022 could be a turning point for biosimilars as approvals expand into new therapeutic areas and sites of care and reimbursement models continue to evolve.18 However, there are numerous and multifaceted barriers, impediments, and limiting factors to broader uptake of biosimilars that make it more difficult for manufacturers, as well as medical practices, to participate in the biosimilar market. These challenges threaten patient access to more affordable treatments and billions in annual savings for the U.S. health care system. Advocates believe that achieving the higher end of potential savings from biosimilar competition will require action by policymakers in Congress and the U.S. Department of Health & Human Services.

Authors & Contributors

A special thank you to the COA Biosimilars Committee for their contributions to this report:

- Kathy Oubre, MS, Co-Chair, Pontchartrain Cancer Center, Covington, LA

- Edward “Randy” Broun, MD, Co-Chair, OHC (Oncology Hematology Care), Cincinnati, OH

- Robert Baird, RN, MSA, National Cancer Treatment Alliance, Washington, DC

- Leslie “Les” Busby, MD, Rocky Mountain Cancer Centers, Boulder, CO

- Michael Diaz, MD, Florida Cancer Specialists & Research Institute, Petersburg, FL

- Bob Phelan, Cancer Specialists of North Florida, Jacksonville, FL

- William “Bud” Pierce, MD, Oregon Oncology Specialists, Salem, OR

- Jeff Vacirca, MD, FACP, New York Cancer & Blood Specialists, East Setauket, NY

COA also thanks Kathleen Ogle, Nicolas Ferreyros, and Michelle Bolger for their writing, editing, and oversight of this report.

About the Community Oncology Alliance

The Community Oncology Alliance (COA) is the only non-profit organization dedicated solely to preserving and protecting access to community cancer care, where the majority of Americans with cancer are treated. COA helps the nation’s community cancer clinics navigate a challenging practice environment, improve the quality and value of cancer care, lead patient advocacy, and offer proactive solutions to policymakers. To learn more, visit www.CommunityOncology.org

References

- Biosimilars in the United States 2020-2024. IQVIA Institute for Human Data Science. October 2021.

https://www.iqvia.com/insights/the-iqvia-institute/reports/biosimilars-in-the-united-states-2020-2024. - U.S. Biosimilars Report. August 2022. AmerisourceBergen.

https://www.amerisourcebergen.com/insights/manufacturers/biosimilar-pipeline-report - FDA Approves First Interchangeable Biosimilar Insulin Product for Treatment of Diabetes. July 28, 2021.

https://www.fda.gov/news-events/press-announcements/fda-approves-first-interchangeable-biosimilar-insulin-product-treatment-diabetes - FDA Approves Cyltezo, the First Interchangeable Biosimilar to Humira. October 18, 2021.

https://www.fda.gov/news-events/press-announcements/fda-approves-cyltezo-first-interchangeable-biosimilar-humira - Politico Prescription Pulse. October 22, 2021.

https://www.politico.com/newsletters/prescription-pulse/2021/10/22/cdc-approves-mix-and-match-covid-19-boosters-798388 - The U.S. Generics & Biosimilar Medicines Savings Report. 2021. Association for Accessible Medicines.

https://accessiblemeds.org/sites/default/files/2021-10/AAM-2021-US-Generic-Biosimilar-Medicines-Savings-Report-web.pdf - FDA TRACK: Center for Drug Evaluation & Research. Pre-Approval Safety Review. Biosimilars Dashboard. March 22, 2022.

https://www.fda.gov/about-fda/fda-track-agency-wide-program-performance/fda-track-center-drug-evaluation-research-pre-approval-safety-review-biosimilars-dashboard - Mariotto AB, Enewold L, Zhao J, Zeruto CA, Yabroff KR. Medical Care Costs Associated With Cancer Survivorship in the United States. Cancer Epidemiol Biomarkers Prev. 2020;29(7):1304-12.

https://aacrjournals.org/cebp/article/29/7/1304/72361/Medical-Care-Costs-Associated-with-Cancer - American Cancer Society. Facts and Figures 2021.

https://www.cancer.org/content/dam/cancer-org/research/cancer-facts-and-statistics/annual-cancer-facts-and-figures/2021/cancer-facts-and-figures-2021.pdf - Report: Biosimilars Have Significantly Lowered Prices of All Biologics. Biosimilars Forum.

https://biosimforum.wpengine.com/wp-content/uploads/Xcenda-ASP-One-Pager.pdf - Yang J, Liu R, Ektare V, Stephens J, Shelbaya A. Does Biosimilar Bevacizumab Offer Affordable Treatment Options for Cancer Patients in the USA? A Budget Impact Analysis from US Commercial and Medicare Payer Perspectives. Appl Health Econ Health Policy. 2021;19:605-618.

https://pubmed.ncbi.nlm.nih.gov/33506318/ - The Use of Medicines in the U.S.: Spending and Usage Trends and Outlook to 2025. IQVIA Institute for Human Data Science. May 2021.

https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/the-use-of-medicines-in-the-us/iqi-the-use-of-medicines-in-the-us-05-21-forweb.pdf - Community Oncology Alliance. Biosimilars Position Statement. April 4, 2019

https://communityoncology.org/position-statements/biosimilars-community-oncology-alliance-position-statement/ - Denduluri N, Somerfeild M, Chavez-MacGregor M, et al. Selection of Optimal Adjuvant Chemotherapy and Targeted Therapy for Early Breast Cancer: ASCO Guideline Update. J Clin Oncol. 2020;39: 685-693).

https://ascopubs.org/doi/full/10.1200/JCO.20.02510 - NCCN Announces New Biosimilars Research Projects in Oncology in Collaboration with Pfizer. March 15, 2021.

http://www.nccn.org/home/news/newsdetails?NewsId=2652 - Nahleh Z, Lyman GH, Schilsky RL, et al. Use of Biosimilar Medications in Oncology. JCO Oncol Pract. 2022;18(3):177-186.

https://ascopubs.org/doi/10.1200/OP.21.00771 - The Costs of Cancer 2020 American Cancer Society Cancer Action Network. October 2020.

Costs-of-Cancer-2020-10222020.pdf (fightcancer.org) - 2022 Biosimilars Report: The U.S. Journey and Path Ahead. Cardinal Health.

https://www.cardinalhealth.com/content/dam/corp/web/documents/Report/cardinal-health-2022-biosimilars-report.pdf. - A Successful Model for Integrating Biosimilars in a Community Oncology Practice. Charlie Dawson. Oncol Pract Manag. 2021;11(8).

https://oncpracticemanagement.com/issues/2021/august-2021-vol-11-no-8/2380-a-successful-model-for-integrating-biosimilars-in-a-community-oncology-practice - McGlynn KA, McGarry J, Patel KB, Clinton Real-World Trends in Biosimilar Prescribing Among Oncology Providers. 2019-2021. Presented at: ASCO 2021: June 3-7, 2021. Abstract e18701.

https://ascopubs.org/doi/10.1200/JCO.2021.39.15_suppl.e18701 - COA Reports Improved Biosimilar Access in Oncology. Tony Hagen. Am J Manag Care. November 15, 2021.

https://www.ajmc.com/view/coa-reports-improved-biosimilar-access-in-oncology - What Incentivized These Oncology Clinics to Embrace Biosimilars? Anna Rose Biosimilar Development. October 23, 2019.

https://www.biosimilardevelopment.com/doc/what-incentivized-these-oncology-clinics-to-embrace-biosimilars-0001 - Study: OCM Reduces Use of Some Supportive Care Medications and Boosts Filgrastim Biosimilar Use. Am J Manag Care. Tony Hagen. The Center for Biosimilars. June 8, 2021.

https://www.centerforbiosimilars.com/view/ocm-study-ocm-reduces-use-of-some-supportive-care-medications-and-boosts-filgrastim-biosimilar-use - Nabhan C, Parsad S, Mato AR, Feinberg BA. Biosimilars in Oncology in the United States: A Review. JAMA Oncol. 2018;4(2):241-247. doi:

10.1001/jamaoncol.2017.2004 - Biosimilars (Mar Update): So Far, Biosimilars Are Providing an Effective Cost Control Mechanism in the US; Market Update. Bernstein.

- National Alliance of Healthcare Purchaser Coalitions. Improving Drug Management: Employer Strategies on Biosimilars. 2022.

https://connect.nationalalliancehealth.org/HigherLogic/System/DownloadDocumentFile.ashx?DocumentFileKey=838ac998-1d74-c605-0ced-df70df38ba9b&forceDialog=0 - The US Biosimilars Market: Shaking the ‘Laggard’ Label. ICON. May 2020.

https://www.iconplc.com/news-events/thought-leadership/the-us-biosimilars-market-shaking-the-laggard-label/ - Strategies for Successful Adoption of Biosimilars in Practice: Takeaways from the West Cancer Center Experience.

https://www.ajmc.com/view/strategies-for-successful-adoption-of-biosimilars-in-practice - Biosimilar Competition: Not Your Grandmother’s Generics Market. Biosimilar Development. Anna Rose Welch. July 29, 2020.

https://www.biosimilardevelopment.com/doc/biosimilar-competition-not-your-grandmother-s-generics-market-0001 - Aligning with Cancer Centers to Spur Biosimilar Uptake. Anna Rose Welch. Biosimilar Development. March 31, 2020.

https://www.biosimilardevelopment.com/doc/aligning-with-cancer-centers-to-spur-biosimilar-uptake-0001 - Barriers and Potential Paths for Biosimilars in the United States. Jennifer Carioto, Harsha Mirchandani. Milliman. 2018.

https://www.milliman.com/en/insight/barriers-and-potential-paths-for-biosimilars-in-the-united-states - Pharmacy Benefit Managers and Their Role in Drug Spending. April 22, 2019.

https://www.commonwealthfund.org/publications/explainer/2019/apr/pharmacy-benefit-managers-and-their-role-drug-spending. - How Did Kaiser Permanente Reach 95%+ Utilization of Biosimilar Herceptin and Avastin so Quickly? Biosimilars Review & November 7, 2019.

https://biosimilarsrr.com/2019/11/07/ - How Kaiser Permanente Built a Biosimilar Empire – the Inside Story. Anna Rose Welch. Biosimilar Development. February 7, 2020.

https://www.biosimilardevelopment.com/doc/how-kaiser-built-a-biosimilar-empire-the-inside-story-0001 - Examining Hospital Price Transparency, Drug Profits, & the 340B Program. Aharon (Ronny) Gal. Moto Bioadvisors. September 2021.

https://communityoncology.org/wp-content/uploads/2021/09/Moto-COA-340B_Hospital_Markups_Report.pdf - Coukell, Allan, Frank, Richard G. Reform Medicare Part B to Improve Affordability and Equity. Rena Conti, Francis J. Crosson, Health Affairs. June 25, 2021.

https://www.healthaffairs.org/do/10.1377/forefront.20210622.349716/full/) - Rome BN, Sarpatwari A. Promoting Biosimilar Competition by Revising Medicare Reimbursement JAMA Network Open. November 15, 2021.

https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2786141 - Dickson SR, Kent T. Association of Generic Competition With Price Decreases in Physician- Administered Drugs and Estimated Price Decreases for Biosimilar Competition. JAMA Network Open. 2021;4(11):e2133451. doi:10.1001/jamanetworkopen.2021.33451

- Medicare Part D and Beneficiaries Could Realize Significant Spending Reductions With Increased Biosimilar Use. U.S. Department of Health and Human Services Office of Inspector General. March 2022.

https://oig.hhs.gov/oei/reports/OEI-05-20-00480.pdf - Yazdany J. Failure to Launch: Biosimilar Sales Continue to Fall Flat in the United States. Arthritis Rheumatol. 2019; 72(6):870-873.

- Case Study: Dean Foods Attempts Savings via Specialty Carve-Out. Skylar Jeremias. Am J Manag Care. The Center for Biosimilars. October 17, 2020.

https://www.centerforbiosimilars.com/view/case-study-dean-foods-attempts-savings-from-specialty-carve-out - Mulcahy, Andrew W., Hlavka, Jakub P., Case, Spencer R. Biosimilar Cost Savings in the United States: Initial Experience and Future Potential. Rand Corporation. 2017.

http://www.rand.org/content/dam/rand/pubs/perspectives/PE200/PE264/RAND_PE264.pdf - Amgen 2021 Biosimilar Trends Report.

https://www.amgenbiosimilars.com/commitment/-/media/Themes/Amgen/amgenbiosimilars-com/Amgenbiosimilars-com/pdf/USA-CBU-80962_Amgen-2021-Biosimilar-Trends-Report.pdf

The Promise of Biosimilars in Cancer Care and Reality of the U.S. Market

Introduction

Biological products, or biologic drugs, have transformed the way patients with many diseases, including cancer, are treated. Some examples of biologics include hormones, blood products, cytokines, growth factors, vaccines, gene and cellular products, fusion proteins, insulin, interferon, and monoclonal antibody products. Biologics are expensive, ranging in cost from tens of thousands of dollars to hundreds of thousands of dollars each year per patient. As biologic drugs lose their patent protection, there exists an opportunity for the introduction of “biosimilar” drugs. A biosimilar is a copy of a biologic medicine that is similar, but not identical, to the original medicine. It may be used in patients who have been previously treated with the reference product, as well as patients who have not previously received the reference product.

A Look at the Data and Evidence to Date

Biosimilar drugs have the potential to provide more treatment options, improve access to lifesaving medications, and lower health care costs through increased competition. All these benefits depend on how many biosimilar drugs are developed, approved, and become available to patients. This paper examines the status of biosimilars in the U.S. health care system, with a focus on biosimilars for the treatment of cancer, and the various obstacles that are slowing their utilization.

Biological products, or biologic drugs, have transformed the way patients with many diseases, including cancer, are treated. Some examples of biologics include hormones, blood products, cytokines, growth factors, vaccines, gene and cellular products, fusion proteins, insulin, interferon, and monoclonal antibody products. Biologics are expensive, ranging in cost from tens of thousands of dollars to hundreds of thousands of dollars each year per patient. As biologic drugs lose their patent protection, there exists an opportunity for the introduction of “biosimilar” drugs. A biosimilar is a copy of a biologic medicine that is similar, but not identical, to the original medicine. It may be used in patients who have been previously treated with the reference product, as well as patients who have not previously received the reference product.

U.S. Biologics and Biosimilars Market

Biologic drugs represent an expensive and rapidly growing segment of pharmaceutical drug spending due to the high costs associated with their development and manufacturing. In 2019, the U.S. spent $493 billion on medicines, including $211 billion on biologics—43% of total medicine spending.1 As a segment of the pharmaceutical drug market, biologics spending grew at a rate of 14.6% over the past five years compared to the total drug market growth rate of 6.1% (small molecules, biologics, and biosimilars), according to IQVIA.1

In 2015, Zarxio [filgrastim-sndz, Sandoz] became the first biosimilar to be approved by the Food and Drug Administration. Zarxio is biosimilar to Amgen’s Neupogen, a myeloid growth factor used to treat neutropenia caused by chemotherapy or radiotherapy to treat cancer. As of August 4, 2022, there are 37 approved biosimilars (see Table 1) and 22 launches, with the majority for the treatment of cancer or supportive therapy. There are now multiple approved biosimilars of rituximab [Rituxan, Genentech], trastuzumab [Herceptin, Genentech], and bevacizumab [Avastin, Genentech]; in the supportive therapy category, there are multiple biosimilars for filgrastim, pegfilgrastim [Neulasta, Amgen], and a biosimilar for epoetin alfa [Epogen/Procrit, Amgen/Janssen]. Outside of oncology, there are biosimilars for insulin, TNF (tumor necrosis factor) blockers for the treatment of autoimmune diseases, as well as ranibizumab [Lucentis, Genentech] for macular degeneration, which launched in June.2

In July 2021, the FDA approved the first interchangeable biosimilar, Semglee [insulin glargine-yfgn, Viatris], which is biosimilar to the long-acting insulin Lantus [Sanofi].3 It is the first biosimilar in diabetes care, and since it is primarily dispensed at retail pharmacies, it is billed under the pharmacy benefit. Cyltezo [adalimumab-adbm, Boehringer Ingelheim], initially approved in 2017 as a biosimilar to Humira, was approved as the first interchangeable product referencing adalimumab in October 2021, making it the second interchangeable product approved by FDA.4 Cyltezo won’t be marketed until July 1, 2023, because of a patent settlement agreement, and not all of the drug’s indications will be included on Cyltezo’s label because of existing marketing exclusivity.5 In August 2022, the FDA approved the first biosimilar interchangeable with ranibizumab [Lucentis, Genentech].2

At least five more biosimilars are scheduled to enter the U.S. market in 2023 as biosimilar versions of adalimumab, which is used to treat rheumatoid arthritis, Crohn’s disease, ulcerative colitis, and several other conditions. These launches are the result of patent settlements allowing the biosimilars to enter the market before the expiration of patents on the reference biologic. Litigation is ongoing between the manufacturer of Enbrel [Amgen], used to treat arthritis, psoriasis, and other conditions, and biosimilar manufacturers, blocking Erelzi [etanercept-szzs, Sandoz] and Eticovo [etanercept-ykro, Samsung Bioepis] from coming to market.6

There are 97 biosimilar development programs underway.7 In addition to oncology, supportive care, and rheumatology, therapeutic areas in which biosimilars are being developed include ophthalmology, fertility, growth hormone, immunosuppressants, and long- and short-acting insulin.2

Biosimilars Help Reduce Health Care Costs, Including Cancer Treatment

The National Cancer Institute estimates that cancer-related direct medical costs in the U.S. were $183 billion in 2015 and are projected to increase to $246 billion by 2030, a 34% increase based only on population growth and aging. However, the projection is likely an underestimate because of the increasing costs of medicines to treat cancer, including biologics.8,9

The prescribing of biosimilars saved the U.S. health care system $7.9 billion in 2020, more than tripling the $2.5 billion saved in 2019, according to the Association for Accessible Medicines (AAM), the trade association of generic and biosimilar manufacturers.6 Use of lower cost biosimilars has provided $12.6 billion in savings since 2011.6 Savings as a result of biosimilars has been estimated between $85 billion and $133 billion in aggregate by 2025.1

The average price discount of biosimilars within each molecule type averages 30% less than their reference brand biologic.1 Biosimilars also help keep prices in check for reference biologics. Xcenda examined the average sales price (ASP) of brand name reference biologics beginning two years before the first biosimilar competitor for each reference biologic entered the market. They tracked the trended ASP of the brand name reference biologics and the first biosimilar that became available to determine how the introduction of biosimilar competition affects the ASPs for brand name reference biologics. The report found that every brand name biologic was on track to have a higher ASP in the absence of biosimilars with an ASP estimated to be 56% higher without biosimilar competition.10

Biosimilars Are Not Generics

Biosimilar drugs may be likened to generic drugs in that they are versions of brand name drugs whose patent has expired. Biosimilars and generics are approved through abbreviated regulatory pathways that avoid duplicating costly clinical trials. However, biosimilars are not generics and there are important differences between biosimilars and generic drugs.1

Generic drugs are made from small molecules and are chemically synthesized as identical equivalents to the reference product. Generic drug makers use the exact same process as the brand name manufacturer and the product has the same active ingredients, strength, dosage, and route of administration as the reference product. Although generic manufacturers are not required to test their products in clinical trials, the FDA conducts a rigorous pre-approval review to ensure generics have the same quality and efficacy as the branded product. Because the active ingredients in the generic product are identical to its brand-name counterpart, it can be substituted at the pharmacy.2

The Drug Price Competition and Patent Term Restoration Act (Public Law 98-417) of 1984, known as the Hatch-Waxman Act, encouraged the manufacture of generic drugs and outlined the process for pharmaceutical manufacturers to file an Abbreviated New Drug Application (ANDA) for approval of a generic drug by the FDA.3 Before the Hatch-Waxman Act, only 19% of prescriptions in the U.S. were generics, whereas today generics comprise approximately 90% of the market.4

In contrast, biological products are created from large complex molecules produced through biotechnology in a living system, such as a microorganism, plant cell, or animal cell, thus making an identical copy impossible. Since the process of making a biologic drug cannot be replicated exactly, a biosimilar is created that is highly similar to the original biologic.6 In fact, no two biological products can be identical.7

In 2010, Congress passed the Biologics Price Competition and Innovation Act (BPCIA) as part of the Patient Protection and Affordable Care Act, creating an abbreviated licensure pathway for biological products that are demonstrated to be biosimilar to, or interchangeable with, an FDA-approved biological product. This pathway was established as a way to encourage biosimilar competition and reduce drug spending on expensive brand-name biologics, similar to the way Hatch-Waxman Act fostered the use of generics.8

- http://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

- NCSL LegisBrief, 01-2022, PDF p 2, col 1, para 1-2

- Mossinghoff Food Drug law J., 1999; 54(2):187-94

- NCSL LegisBrief, 01-2022, PDF p 2, col 2, para 6

- NCSL LegisBrief, 01-2022, PDF p 2, col 1, para 3

- Morrow T, et Biotechnol Healthc, 2004; 1(4):24-29

- http://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

The significant growth in biosimilars savings has been primarily driven by oncology biosimilars bevacizumab, rituximab, and trastuzumab. These therapies were launched in late 2019 and quickly progressed to 74%, 64%, and 60% market share respectively at a significant discount relative to their reference products.6 The savings resulting from the use of biosimilars in the treatment of cancer is being documented in a growing body of medical literature. One study examined the effect of gradually shifting patients to Zirabev [bevacizumab- bvzr, Pfizer] biosimilar over five years. Assuming an annual market shift of 1.7%, 3.5%, 6.7%, and 11.9% to bevacizumab- bvzr, an annual cost savings of $313,363 was estimated for a commercial payer and $92,880 for Medicare in Year 1. Cumulative five-year cost savings were $7,030,924 for a commercial payer and $4,059,256 for Medicare. More than half of the cost savings was attributed to patients with metastatic colorectal cancer.11As a direct result of biosimilar competition, oncology spending growth declined from about 16% in 2018 to 10% in 2020, and it is projected to decline further, helping control oncology spending in the years ahead, even as the new higher-priced oncology drugs come to market.12

Oncologists Have Embraced Biosimilars

Medical societies representing oncologists have endorsed the use of biosimilars. In 2019, the Community Oncology Alliance (COA) released a position statement saying that it will work with stakeholders to support the acceptance of biosimilars by educating oncologists.13 In October 2020, the American Society of Clinical Oncology (ASCO) published an update to its guideline on treating early-stage breast cancer in which it endorsed the use of biosimilar trastuzumab.14 Last year, the National Comprehensive Cancer Network (NCCN) Oncology Research Program announced it was collaborating with Pfizer Inc. to fund 10 projects to improve processes related to biosimilar adoption in oncology.15 Earlier this year, an ASCO expert panel supported the inclusion of FDA-approved biosimilars in clinical practice guidelines.16 The American Cancer Society’s annual “Costs of Cancer” report detailed how a patient with breast cancer underwent drug therapy spanning multiple years. The brand-name biologic drug would have cost $74,487, but the biosimilar version was $58,906 yielding the patient and her insurer/employer a savings of 21%.17

Cardinal Health has been conducting research about biosimilars with oncologists since 2015 to assess their familiarity and understanding of biosimilars and to identify concerns and barriers that might impede adoption. Results of surveys conducted during the 2020-2021 time period include the following:

- 53% of oncologists surveyed described themselves as very familiar and 39% described themselves as somewhat familiar with Only 6% said they were “not very familiar.”

- When asked for which patients they would most likely prescribe a biosimilar, 67% said new patients, and 67% said existing patients having success on a reference product, with 27% saying existing patients having limited success on a reference product.

- More than nine in 10 participating oncologists said they were comfortable prescribing a biosimilar with an FDA approval based on extrapolation. Only 5% of participating oncologists said they would not prescribe biosimilars for indications without clinical trial data.

- More than seven in 10 participating oncologists said they are “very” or “moderately” comfortable with automatic substitution of biosimilars.

- Since 2015, acceptance of interchangeability has evolved from 22% in 2017 to nearly 100% for some indications in 2021.

- Participating oncologists said they felt comfortable switching patients to biosimilars for both curative and palliative intent.

- More than 90% of participating oncologists said they are comfortable switching between biosimilars in at least some cases.

- 68%, 62%, and 67% of oncologists had prescribed biosimilars to trastuzumab, bevacizumab, and rituximab, respectively in the past year.18

In 2020, Texas Oncology, a large community practice, converted to biosimilars using a physician-approved pharmacist-driven, care-team approach. From January to December, the practice increased utilization of biosimilars for rituximab from 5% to 80%, bevacizumab from 9% to 88%, and trastuzumab from 8% to 74%. Estimated cost savings per dose-based average sales price were $550 for bevacizumab, $850 for trastuzumab, and $1,400 for rituximab. With using biosimilars for the three drugs alone, the practice has surpassed 85% biosimilar usage. In one month, the use of the three biosimilars reduced costs 21% or $4 million.19

An analysis of real-world prescribing found rapid uptake of biosimilars among oncology providers between 2019 and 2021, according to an abstract at ASCO’s 2021 conference. The study authors reported that in the three months following the 2019 launch of trastuzumab’s first biosimilar, trastuzumab-anns [Kanjinti, Amgen], 7.3% of initiating first-line patients were prescribed the biosimilar over the reference product. During the same period in 2020, when a total of five trastuzumab biosimilars were available, 80.5% of initiating first-line trastuzumab patients began treatment on a biosimilar. This differed by product with the initial uptake for the first rituximab biosimilar, rituximab-pvvr [Ruxience, Pfizer], at only 2.3%. The study also revealed that oncologists were willing to switch patients to a biosimilar: 11.1% of all patients (bevacizumab: 11.3%, trastuzumab: 14.1% and rituximab: 7.9%) switched from a reference product to a biosimilar during treatment. Among patients on trastuzumab at the time of its first biosimilar launch, 18.2% switched to trastuzumab-anns in the first 90 days post-launch. Costs per prescription were significantly lower for biosimilars, 42%, 29.9% and 89.5%, relative to the reference products for trastuzumab, rituximab, and bevacizumab, respectively.20

A study of community oncology practices found a dramatic increase in the adoption of biosimilars for bevacizumab and trastuzumab, which were first marketed in July 2019. In the fourth quarter of that year, participating practices reported 8,000 administrations of bevacizumab vs. 21,000 for the reference product, representing a 29% share of administrations for biosimilar bevacizumab. By the fourth quarter for 2020, bevacizumab biosimilars had achieved a 72% share of the administrations, or roughly 31,000 in total and 18,000 for bevacizumab biosimilars vs. 13,000 for the reference product. In the fourth quarter of 2019, trastuzumab biosimilars accounted for about 8,000 administrations vs. 16,000 for the reference product, representing a 35% share of administration for biosimilar trastuzumab. The biosimilar share grew to 79% of administration by the fourth quarter of 2020 (65,000 biosimilar administrations vs. 29,000 reference product administrations, roughly). Other biosimilars used in oncology also saw gains from inception to the fourth quarter of 2020, including rituximab [Rituxan, Genentech], infliximab [Remicade, Janssen] and pegfilgrastim [Neulasta, Amgen].21

Value-Based Care Drives Biosimilar Adoption

Oncology practices participating in the Oncology Care Model (OCM) were early adapters of biosimilars. Initiated by The Centers for Medicare and Medicaid Services (CMS), the OCM pilot involved approximately 175 practices and 14 payers that were incentivized to transform their practices from volume-based to value-based and provide more efficient and cost-effective care under Medicare. Jeffrey Patton, MD, the CEO of OneOncology, Chairman of the Board of Tennessee Oncology, and member of the COA Board of Directors, told Biosimilar Development: “It just makes sense. If you’re in this program where you have the opportunity for shared savings, you want to work towards lowering the total cost of care and saving money. Biosimilars will be a critical driver for us to generate savings in Medicare, and once we hit a certain threshold, a portion of those savings will be shared with our clinics.” Biosimilar Development concluded that oncologists’ experience with biosimilars may serve as a model for clinicians treating patients in other therapeutic areas where biosimilars become available.22 Further, value-based initiatives, such as the OCM and its announced successor the Enhancing Oncology Model (EOM), could serve as models for establishing incentives for biosimilar adoption.23,24

Biosimilar Uptake Has Been Slower Than Expected

Despite a progressive development program and documented costs savings, biosimilar adoption in the U.S. has occurred more slowly than that of Europe, which was 10 years ahead of the U.S. IQVIA estimates a 30% biosimilar share of volume is achieved in the first 24 months after the U.S. launch of a biosimilar along with a 30% reduction compared to the originator drug.1 In contrast, in Europe, biosimilars are at a 50% or greater adoption across the continent, and pricing of biosimilars is sharply down—at least 50% for the biosimilars and reaching 70% to 80% (with EU prices starting lower, at approximately 35% of U.S. prices).25

The reasons why the U.S. is behind Europe in biosimilar adoption include Europe’s national health systems with centralized decision making, which allows them to make these products available to prescribers and patients as soon as they are approved, whereas in the U.S., not all approved biosimilars have launched due to patent litigation. At a national level, European governments create incentives for prescribing and taking biosimilars, since the payment/reimbursement is centrally controlled and consistent throughout the country.26 A report by ICON attributed the more robust European biosimilar uptake to a different patent landscape, the absence of an interchangeability designation, and the U.S.’ fragmented health system in which payers are driven by pricing and manufacturers’ rebates.27

Obstacles to Biosimilar Adoption in the U.S.

Payer coverage for biosimilar treatments has improved greatly over the last two years, according to Cardinal Health, yet providers continue to face familiar obstacles.18 Some payers require the reference product, and others prefer the reference product so that the reference product must be used prior to the patient trying a biosimilar for that product.28,29 Formularies that stipulate providers use only the reference product or one specific biosimilar present an operational challenge to practices. Because practices must accommodate the formularies of a variety of regional and/or national payers, each clinic must stock all the required formulary products, which requires inventory management, electronic health record maintenance, and expanded administrative duties, including increased prior authorizations. If a non-formulary product is administered, the clinic has to absorb the cost.30 Drug coverage and payer policies may change multiple times in a given year, which means patients may be switched to a new biosimilar product multiple times a year.

In a survey of 52 practices, COA found the following payer restrictions on biosimilar use:

- 44% reported that at least one payer requires them to use a reference product instead of a biosimilar.

- 59% said they are required to stock multiple biosimilars for the same drug because different payers have different formulary requirements.

- 37% are required to follow payer step therapy requirements before they can use a practice’s preferred biosimilar 21

Biosimilars Are as Safe and Effective as Their Reference Biologics

The BPCIA specifies that a manufacturer developing a proposed biosimilar must demonstrate that its product is “highly similar” to and has “no clinically meaningful differences” from the reference product in purity and potency, efficacy, and safety. This is generally demonstrated through human pharmacokinetic and pharmacodynamic studies, an assessment of clinical immunogenicity, and, if needed, additional clinical studies.1 Other factors that are the same between a biosimilar and its reference brand product include the route of administration, the strength and dosage form and the potential side effects.1

There is a separate regulatory process in which a biosimilar may be designated “interchangeable” with an FDA-approved biological product. An interchangeable biosimilar product meets additional requirements to show that it is expected to produce the same clinical result as the brand name or “reference” product in any given patient. Also, for products administered to a patient more than once, the risk in terms of safety and reduced efficacy of switching back and forth between an interchangeable product and a reference product will have been evaluated. Biosimilars that are interchangeable may be substituted for the reference product without consulting the prescriber, subject to state law, similarly to the way a pharmacist may substitute a generic drug for a brand name drug when filling a prescription.1

In 2021, President Biden’s Executive Order Promoting Competition in the American Economy directed the U.S. Department of Health and Human Services “to increase support for generic and biosimilar drugs, which provide low-cost options for patients.” The order contained provisions encouraging the FDA and FTC to prohibit certain anticompetitive practices that impede the entry of biosimilars to the market.2 Advocates believe policy changes will be required to remove incentives for using more expensive treatment options if biosimilars are to fulfill their potential.

- Biosimilars. March 8, 2022. https://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

- FACT SHEET: Executive Order on Promoting Competition in the American Economy. July 9, 2021. https://www.whitehouse.gov/briefing-room/statements-releases/2021/07/09/fact-sheet-executive-order-on-promoting-competition-in-the-american-economy/

Rebates Push PBMs to Select More Expensive Drugs

Although biosimilar drugs are generally priced lower, stakeholder incentives are not always aligned to enable or support biosimilar adoption.18 Pharmacy benefit managers (PBMs) are companies that manage pharmacy benefits for health insurers, Medicare Part D drug plans, large employers, and other payers. As PBMs use their purchasing power to negotiate with drug manufacturers, they often receive rebates and discounts that are calculated as a percentage of the manufacturer’s list price. Brand manufacturers can compete by increasing their rebates to encourage payers to maintain a preference for the brand biologic on their formulary.31 Although the PBM’s role is to control drug spending, the manufacturer that provides the largest rebate wins the preferred product slot on the formulary, even if the drug is more expensive than other options, such as a biosimilar. As a result, patients who have a high-deductible plan or have copays based on a drug’s list price may incur higher out-of- pocket costs.32

Kaiser Permanente uses an evidence-based approach to its formulary and the biosimilar adoption process. It also declines to accept rebates, and, as a result, its biosimilar utilization is high. Sameer Awsare, MD, associate executive director of The Permanente Medical Group, has described how their physicians questioned the results of the European studies of Zarxio, the first biosimilar to receive approval in the U.S. Kaiser performed a study with its own patients and found less neutropenia than with the reference drug Neupogen. As a result, Kaiser Permanente had 98% uptake of Zarxio in 2019, followed by high uptake of biosimilars to infliximab, trastuzumab, bevacizumab, and rituximab.33,34 Since Kaiser Permanente manages its own formulary—it operates as its own payer and has its own medical groups employing 23,000 physicians and 60,000 nurses and staff taking care of 12.3 million patients—it is protected from the middlemen, such as PBMs, that drive up the cost of health care.

340B Hospitals Are Slow to Adopt Biosimilars

An analysis of disproportionate share hospitals participating in the 340B Drug Pricing Program, commissioned by COA, and conducted by Aharon (Ronny) Gal, PhD, found that 340B hospitals have been slow to embrace biosimilars as these hospitals profit from the use of higher cost drugs. As part of the Affordable Care Act, hospitals participating in the 340B drug program are required to publish their standard charges. In 2019, CMS revised its guidance to require hospitals to publish a “machine-readable” file containing prices for all “items and services” provided by the hospital to patients for which the hospital has established a standard charge, including maximum negotiated prices, as well as payer-specific negotiated charges, which is the rate that a hospital has negotiated with each third-party payer.

Of the 1,087 acute care 340B hospitals, 890 provided a price transparency file of which 876 were in a readable form; 233 included drug prices; and 123 included individual plan names. Gal noted that 340B hospitals tend to price drugs at a mark-up to their wholesale acquisition cost (WAC) price and retain that price, even if manufacturer prices decline, and most biosimilars establish their WAC prices at a discount to the WAC price of the reference drug to compete in the non-hospital segment. As a result, 340B hospitals have an incentive to prefer reference products because, for the same net-price level, they pocket higher profits. Gal found that 340B hospitals marked up drugs at a median rate of 3.8 times the 340B hospital-discounted acquisition cost. Compared to WAC, drug charges were typically two to three times higher. He found a five-times gap between hospitals’ average allowable charges, and a two- to three-times spread in allowable charges within the same hospital for the same drug. He also found that between 25% and 46% of the hospitals listed prices for only the innovator product and essentially none carried all the biosimilars. There were only a handful of hospitals where only the biosimilars are listed.35

Although biosimilar drugs are generally priced lower, stakeholder incentives are not always aligned to enable or support biosimilar adoption.

Reform Needed for Medicare to Increase Biosimilar Adoption

Another obstacle hindering biosimilar adoption is Medicare’s reimbursement rules, which do not incentivize clinicians to prescribe lower cost drugs, such as biosimilars, and actively reward the prescribers of higher priced drugs. For patients with Medicare, drugs that are administered by clinicians in an outpatient hospital or clinic setting are reimbursed under Medicare Part B, and spending has been growing due to the introduction of expensive drugs, such as biologics. In 2018, the Medicare program and its beneficiaries spent roughly $35 billion on drugs paid through Part B. From 2009 through 2018, Part B drug spending grew at an average of 12%.36

Medicare pays providers for newly launched physician- administered outpatient drugs at WAC plus 3%. Once the new drug has been assigned a unique Medicare billing code, Medicare reimburses providers the ASP plus 6% (reduced to 4.3% by the budget sequester). The switch to payment based on ASP is intended to allow Medicare to share in some of the volume discounts manufacturers give to providers outside of the 340B program.36 This process means that, even if prices fall for one biosimilar product, the prices of the originator biologics and other biosimilars can remain high. This arrangement limits direct price competition and provides an inverse incentive for clinicians to administer the highest-cost product to obtain the greatest reimbursement from Medicare.37 Not surprisingly, a recent study found minimal uptake of biosimilars and limited price reductions for biologics and biosimilars under the current Medicare Part B reimbursement policy whereas there have been steep declines in generic drug costs. If biologics and biosimilars were subject to the same Medicare reimbursement framework as brand-name and generic drugs, Medicare spending on these products was estimated to have been 26.6% lower or $1.6 billion from 2015 to 2019.38

Medicare Part D Plans Favored Biologics Over Less Expensive Biosimilars